If someone – – anyone – – were asked what financial instrument sounded more exciting: The Dow Jones Utilities (XLU) or hot Internet app maker Snap (SNAP), I strongly suspect SNAP would win the day. However, SNAP is a dog, trading at about one-third of its peak and just kind of crawling around the sub-teens (much like its demographic). The Utilities, on the other hand, is a daily obsession of mine.

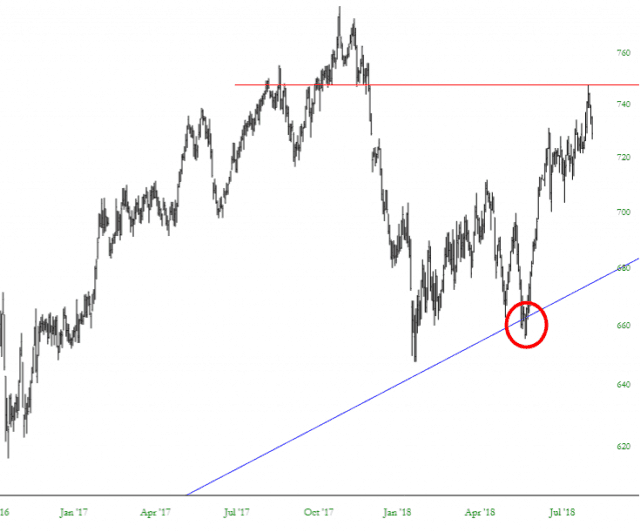

I have a ton of January 2019 puts on this (strike price $54), and after causing a bit of trendline damage earlier this year (red circle), it roared higher and only started weakening a few days ago.

Looking at the long-term chart, you can see the multiple instances of reversal patterns in XLU. The slight damage to the trendline isn’t easy to see in the much larger chart below, but you can certainly see the ascending blue trendline, which is the damaged support. Slightly-damaged, to be sure, but damaged nonetheless.

Taking a closer look, you can see how well-behaved XLU is when it comes to topping patterns (tinted blue areas). We are still very much in the pattern formation phase right now, but I’d say the pattern is about 75%-80% complete.

The past three days have, mercifully, been weaker, even with most equities roaring higher. We need to do more than this, of course. You can see how persistent a trend can be in XLU once it is in place (just take a look at that steady progress of green bars on the left side).

I’m sticking tough with this trade. The Fed affirmed its disposition today about continuing to raise rates on a regular basis, and the long-term picture to my eyes is still very bearish on the Dow Utilities index.