For any masochists out there who want to sell into strength, here are a dozen new shorts I am eyeing. Click any thumbnail to peruse the gallery.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

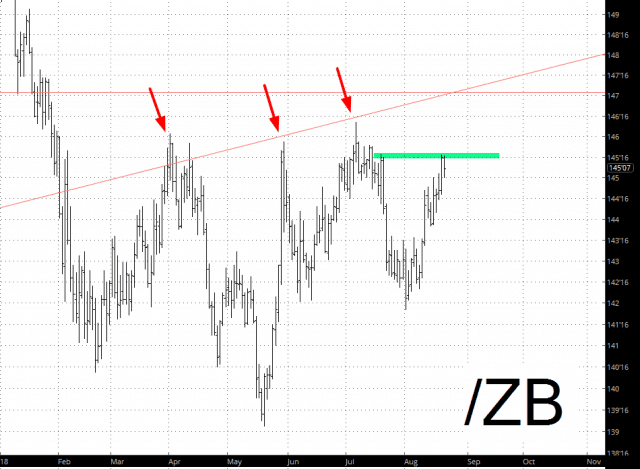

Can Bonds Relax?

The only red on my screen this morning (and it’s down only the tiniest bit) is bonds. This is a market I watch terribly closely, because as I’ve said through most of 2018, the core shift I’m looking for is an increase in interest rates and an accompanying decrease in real estate valuations. Through the course of the year, the now-broken trendline has done an effective job of repelling prices (arrows). At the moment, my fondest hope is that prices don’t either bother getting back to the trendline and instead turn away from that green tinted area.

Just Take The Metals Out Back And Shoot!

So, does my title appropriately capture the sentiment about metals right now?

While the title may seem a bit extreme to some of you, many are leaving the metals for dead, and others have already written their obituaries.

In fact, this past week, just as the metals were hitting what will likely be a bottoming in either a third wave of this decline, or possibly even all of the decline, a headline article came out on MarketWatch entitled “Here’s why gold might die out as an investment.”

Within that article, the writer alludes to the fact that since gold was not able to rally due to the geopolitical tensions around Turkey, then it is a sign it is no longer useful. However, if any of you have read my articles on this issue, you would know that history does not support the premise that gold reacts as a safe haven for geopolitical tensions. This is purely a fallacy. But, since it is regurgitated so often most of the market has taken it as gospel despite the facts suggesting otherwise.

The next premise within the article upon which he declares gold as dead is due to technology, and he is not referring to cryptocurrencies. While he is not wholly clear regarding this perspective, my assumption is that he is falling into the trap of most people in the market. Since the Nasdaq has continued to rally strongly, along with its supporting cast of FAANG, then that is clearly where younger people are going to put their money, rather than gold.

Creep

Before I begin, I want to mention we’ve substantially improved the quality and speed of our real-time index data, so you SlopeCharts users will immediately start enjoying the improvement.

I promise to only mention it a few thousand more times, but please note my new book has out (which just got its first review!) so please check it out.

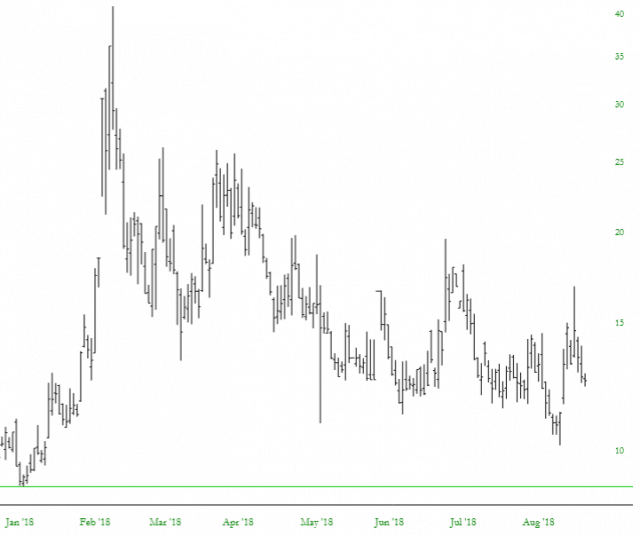

As for the markets, it’s pretty much what I predicted/dreaded last Friday, which is a continuation of the “melt up”. Barring some shock event (e.g. China announces the U.S. can go screw itself, and the trade war is back on) it seems the natural path of the market is simply going to be higher – – – which, let’s face it, makes sense, since it has only been going continuously up for the past nine years. Volatility is, once again, completely dead, which makes for a market more boring than words can describe: