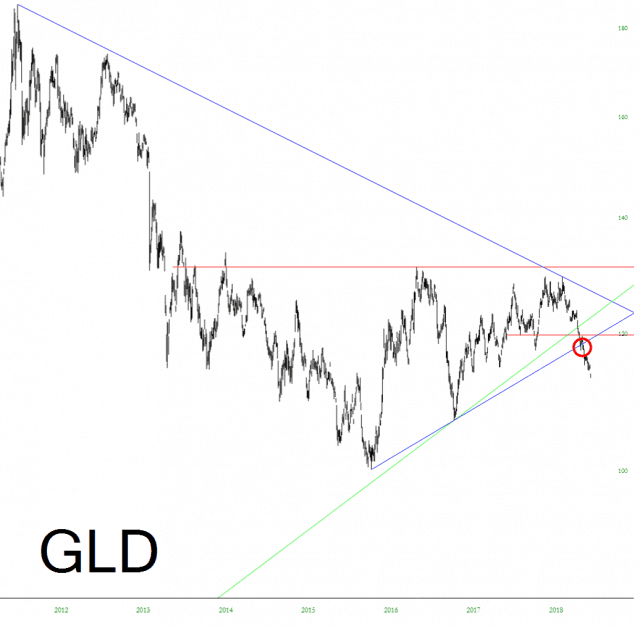

The so-called precious metals sector has been in a bear market for seven solid years (WHY can’t we say the same thing about equities? Can you imagine how glorious that would be, with CNBC out of business and the Dow at 3000?!?!?!) Anyway, it’s just one technical failure after another, which I’ve been pointing out the whole way.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

The Wheels On The Bus Go Round and Round

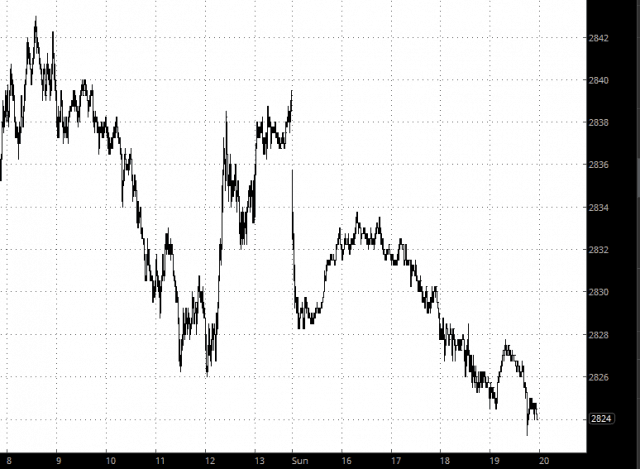

An unsettled open on ES last night with more rumblings from Turkey and lower lows on ES and NQ. I was asked before the open whether I thought there was a serious risk of the wheels coming off on SPX with a 5% or so retracement directly from here, and I replied that I thought that the risk was low, though possible as always.

There are four important support levels below, all shown on the SPX 60min chart. The first is the short term rising wedge support trendline at Friday’s low, supported by the daily middle band. As long as that holds the obvious next target is wedge resistance in the 2870 area. If that should break then there is strong established support in the 2800 area, which would also be the 38.2% retracement of the rising wedge. If 2800 was to break that could be a significant bearish break, but there would still be main channel support, currently in the 2765 area.

On the upside resistance is at the the ES weekly pivot at 2842 and the 50 hour MA on SPX, currently at 2845 and resistance so far both on Friday and today, then the open gap from 2853.58 that would need to be filled. After that the way would be clear for SPX to head back to short term wedge resistance and a likely test of the all time high at 2872.87. (more…)

Bid-a-Bing, Bid-a-Bond

As I tweeted out last night, I spent the entire weekend putting the finishing touches on my latest book, and I am tremendously proud of it. I will be telling you about it (and how to get it) here on Slope a little later this month.

Regarding the markets this morning, I was a little surprised to see (as of this writing, because there are both very close to unchanged) that NQ had flipped green and ES’s low was very small, whereas they had both been down hard when I went to bed last night. It’s not upsetting, though, because, frankly, huge Monday morning selloffs have always been greeted by ruinous government intervention. I’d much rather things be calm. It looks like a good opening for me in any case.

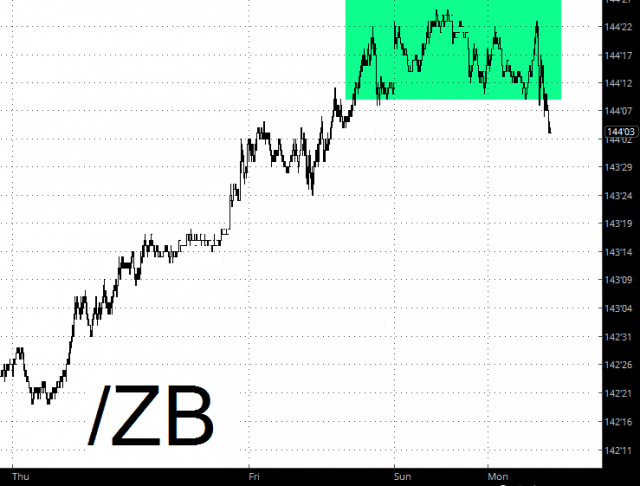

Even more important, my portfolio is quite interest-rate sensitive, and the weaker bonds can be, the better. We’re definitely doing good things in that respect:

I am quite short right now (267% of buying power used) across 74 positions, and there are a handful of others I plan to enter as well. This should be a very interesting week indeed!

Shove a Gag-Ball In His Mouth

I am very, very excited to see what’s happening in the markets.

In Honor Of Our Huge California Fire

Slope’s beloved patron saint, the late, great, genius George Carlin, in one of his most amazing bits ever………