As you’ve no doubt learned, the market is all abuzz this evening about yet another miracle cure. We get these every week or so. Sometimes it’s Gilead. Sometime it’s Novavax. This time, as has happened a number of times before, it’s Moderna. Maybe someone rolls a die to see whose turn it is.

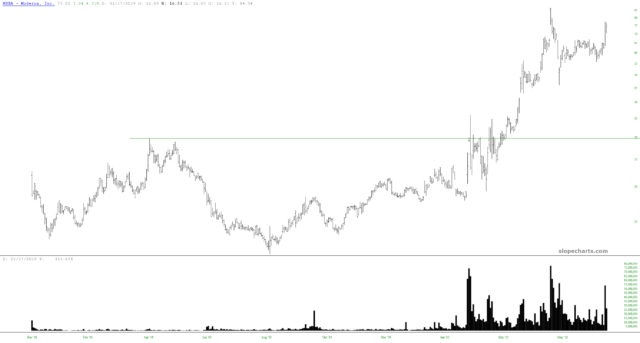

I’ll be the first one to admit the chart above is quite bullish. Indeed, on any number of occasions, I’ve pointed out MRNA as a good bullish chart. The first time I did so, I didn’t even know what they did. As far as I knew, “Moderna” sold modern Scandanavian style furniture. It was just a nice-looking pattern to me.

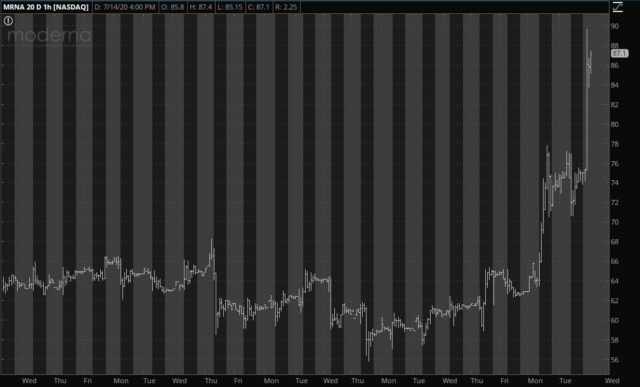

On Tuesday evening, however, it was roaring to lifetime highs after hours on encouraging news about its Covid vaccine.

One might assume that a bear like me wants to see Covid go on forever. Not at all! I mean, I love the fact there’s no traffic anymore, but it’s neither my wish nor my analytical conclusion that Covid-19 is permanent.

On the contrary, my view is that just about the most bearish thing possible for equities would be a slam-dunk cure for this thing. Why is that? Because there is one and only one thing propping up this comically overpriced market, and that is the Fed. And there is one and only one reason they are permitting themselves to throw trillions of dollars at this thing: to deal with the extraordinary situation this pandemic has brought.

The immediate reaction to a cure, of course, is very positive. I am strongly reminded of a classic post I did here on Slope years ago, however, which I called The IFD Trap; here is as germane excerpt:

Idealize: This is the stage where you think to yourself, “Won’t it be great when ____________________” The blank space could be just about anything as you age through life, such as “Christmas is finally here’ or “I start high school” or “I graduate this stupid high school and go to college” or “I get married” or “I have my first child” or “I get divorced from this miserable marriage” or “I get that big promotion” or “my company goes public.” You name it. There’s always some happy event in the future that, you believe, Will Make Things Better Than They Are Now. You anticipate it. You count the days. You can hardly wait until it’s here.

I would submit to you that whenever these drug announcements tumble out, everyone is instantly hurled into the idealization phase. In their minds, the economy and stock market would both be fantastic if only this Covid thing was out of the way. If we can have record highs on the NASDAQ in this situation, imagine how high it could go without the burden of Covid!

I absolutely believe, however, the market would soon realize the trillions of dollars of fake props ushered in to keep the plates in the air would soon be removed, and the next phase would kick in:

Frustration: The day arrives. Whatever it is you were anticipating is finally here, at long last. Perhaps there’s a sense of relief or exhilaration. You are, in fact, happy, just like you thought you would be. And then, sooner than you dared imagine, it starts to fade. The Christmas presents aren’t as fun as you hoped. Being in college and away from your parents isn’t all that great. Being married isn’t what you thought it would be. Having a child isn’t an endless chain of bliss. You’re upset. You’re let down. You’re disappointed.

See, it’s also very much why the running gag in the Silicon Valley – – yet very much the truth – – is the last thing a company wants to have is profits. Because profits can be measured, and P/E ratios can be compared to history. It’s far better to have amazing PowerPoint presentations and the vivid imagination of your investors running wild instead of day in, day out accounting data from a steady profit-maker. If you don’t believe that, explain how a no-product, no-revenue company like Magic Leap has raised over $2 billion in funding. (Who also, incidentally, announced they were shuttering any efforts to create a product for the consumer market).

There’s no reason for me to rehash the entire IFD article. It’s a good piece, and I urge you to check it out. My point, however, is that the short-term exhilaration of a potential cure (which, again, seems to be a weekly event) will soon enough to eclipsed by the reality that a return to normalcy also means an eventual return to adult supervision and meaningful metrics. And that, for the bulls, will be a disaster.