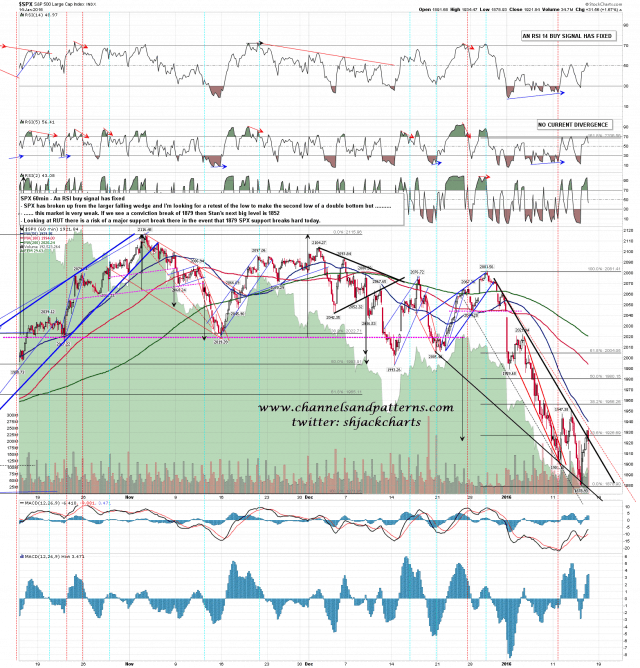

Well the 1879 SPX target really delivered hard yesterday with a impressive 56 handle rally off 1878.93 yesterday. I did mention on twitter though that in the absence of an obvious reversal pattern that there was a significant risk that the low might well be retested, and that there was no obvious reversal pattern. It seems very likely that the 1879 is going to be retested this morning. If that low holds then that sets up a possible double bottom with a target in the 1990 area on a break back over yesterday’s high. If that low breaks hard then Stan’s next level is in the 1852 area, and a really hard break below 1879 opens up a possible retest of the October low at 1820. This is angry tape and needs to be traded with caution and respect. SPX 60min chart:

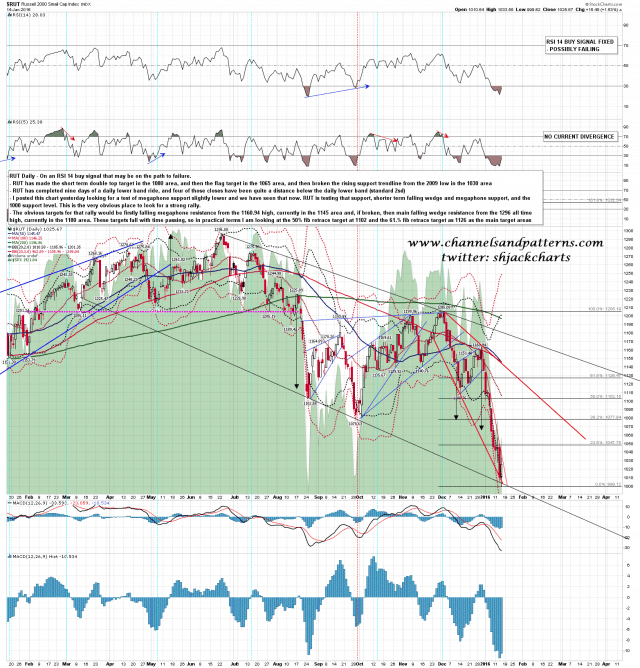

I’ve mentioned a few times now that is the main chart to watch here is RUT, and RUT is a large part of why I am looking for a big rally from this area. RUT is testing double pattern support and the 1000 level here and that is very serious support. I would be surprised and frankly very concerned to see that break today. It should hold. RUT daily chart:

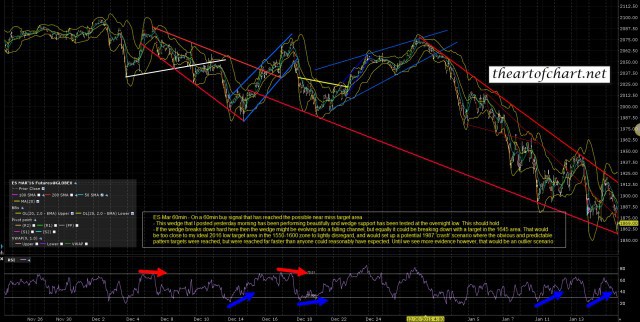

This is also where ES should hold the line as well. This is the ES bonus chart I posted for theartofchart.net subscribers this morning. You can see that wedge resistance held the high yesterday afternoon and that wedge support has been tested this morning. The higher probability trade here is long, though as ever it could still go the other way. ES Mar 60min chart:

This is wild tape, and it’s very easy to get run over in these huge moves. If you aren’t an experienced trader then it might well be better just to watch and learn. This angry tape demands to be treated with respect, and will happily turn traders into roadkill in the absence of that respect. Many trader accounts have imploded since the start of January and there is no need to be a hero and risk joining them.

Stan and I are doing a free to all educational webinar on Thursday 21st January on trading bear trends and if you want to attend you can find the link to sign up for that here. We do similar free to all webinars every two weeks or so on a range of topics.