For those of you who aren’t quite sure whether Slope Plus provides value or not, I wanted to offer this unsolicited email (whose author kindly gave me permission to reprint) to help you in your decision. I’ve made minor edits only to protect the author’s identity and have boldfaced a few items of note.

Tim,

Just wanted to stop by and say thanks. I just joined Plus this December. I am the one who had the credit card issues. I have been a Slope on and off stalker for a few years. I have a bear market personality so I am not sure if it is wise to hang with bears but the wide knowledge base is amazing. I am not near as witty as the folks there and my knowledge is small so I listen and learn and ignore the snarky stuff.

Background: I am a stay at home mom of 4 boys. I am a science teacher by trade. My boys are now grown (24,23,20,19) and I have been working part-time at an inner city school in Green Bay. The grant is geared to get students that are struggling back on track and graduated. The 4 year grant ended this spring. I am now searching for my next thing to do to make a difference.

However, my family comes first and with two of the boys in the Navy (one in Guam) and one in school in CO I want the flexibility to travel at will. While I was working, I was trading on my days off. I now trade daily if the set up is correct. I day trade with my favorite trade done in minutes. Right now I only trade 1 stock.

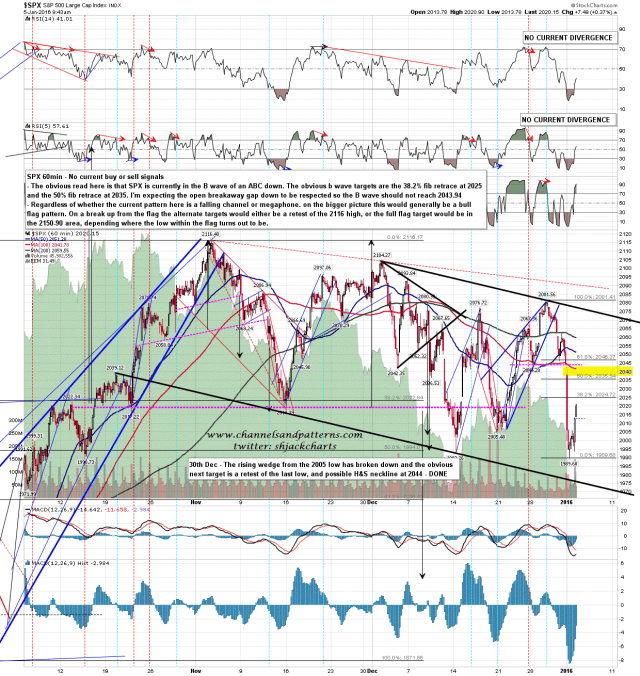

2016: This year I would like to become more of a swing trader. Now when I am out of the office I am in cash. I have no desire to hunt through 100s of stocks a day to find the perfect stock and you give us a variety to pick from. I am starting to go through your videos. Anyway, (sorry to be longwinded) the reason for this shout-out is to let you know I jumped in on two of your Dec. picks. SPY and SCTY. I have a small account so went small with OTM options. Between the two trades, I made +3,000. The reason I tell you this is so when people ask is Slope+ worth the money the answer is yes. Listen and learn and smart trades will come.

Thanks again.