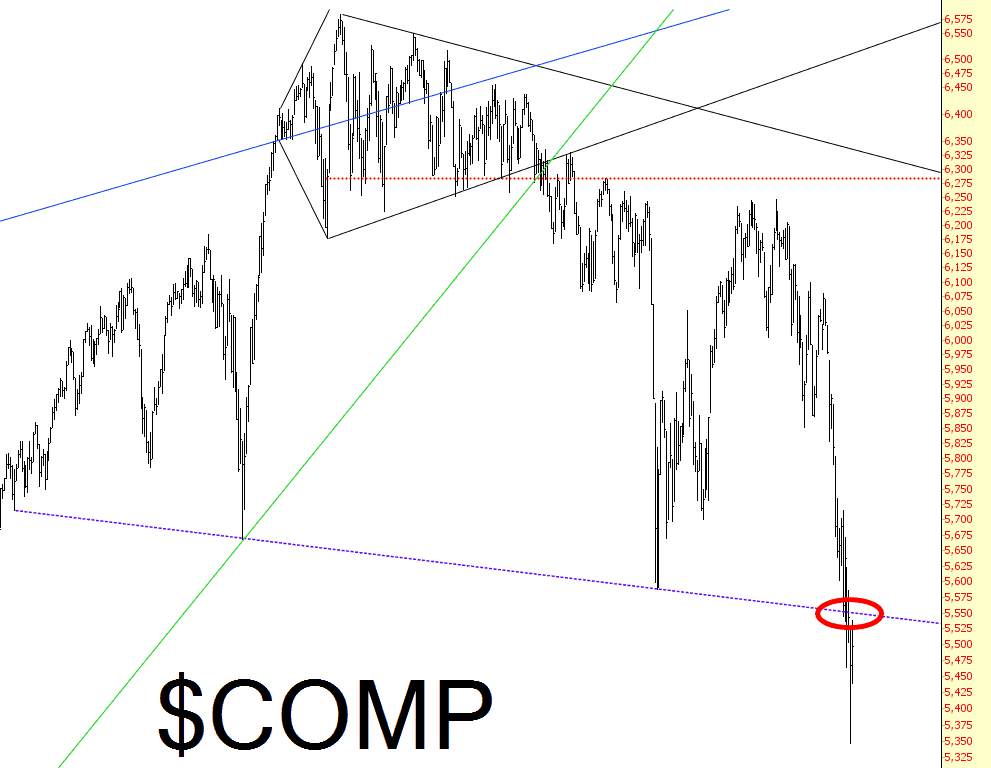

Incredibly, it was just over three weeks ago that the Santa Claus rally had exhaled its last breath, and we begin a breakdown that has been thrilling, riveting, and exhausting. December 30th seems like a lifetime ago, but it wasn’t, and we moved in the span of two weeks to price levels I thought would take months to achieve.

I want to make one simple but very important point, however. There may be bounces, sure – – maybe even a strong one or two. But the damage that has been done to the charts is massive, and a good hard look at the Dow Jones Composite, shown below, illustrates quite clearly that not only is the pattern complete, but the price action is beneath that pattern. I am more confident of my 1577 target on the S&P 500 this year than ever, and I think 2016 is going to be the best trading environment for chartists since 2008.