Well, it seems deathly quiet in comments, and frankly, I don't have anything to say about the markets that I haven't said recently – – so I'm just going to let you good people talk amongst yourselves.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Lazy Trade Long & Short: NTSP & RAI (by Ryan Mallory)

Of the two trades listed below, I'm tempted to add Reynolds American (RAI) as a short position because I think it will struggle even if the market breaks out of the six-day market funk it is in, and if it does run hard against my position, it won't be able to do long without getting stopped out first.

The long setup in NTSP is looking great as well, but you want to wait for the trade to break out of consolidation first which it has yet to do. So patience is required here.

Here's today's lazy trades.

LONG: Netspend Holdings (NTSP):![]()

SHORT: Reynolds American (RAI):

Tasty Poll

As I mentioned on The Last Call today (which is my daily broadcast on TastyTrade, enjoyed by millions around the world), one viewer wrote to me, suggesting I ditch the general market overview and just focus on specific trading ideas. I wanted to get some guidance from more than just one person, so if you actually watch The Last Call, please vote and light my path. Thank you. Oh, and to light your own path, remember to use SocialTrade on a daily basis.

Sept-Oct Options Expiry Pivot Points for Major Indices

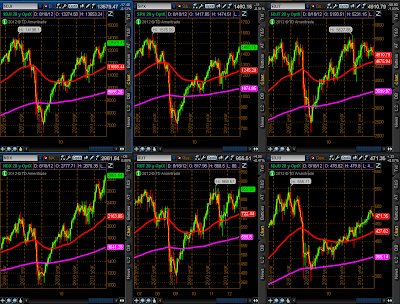

Each candle on the chartgrid of the 6 Major Indices below represents one

monthly Options Expiration period. The last candle shows market

gains/losses for the August-September series and finished on this past Friday's

Options Quadruple Witching.

For the information of any who are interested

in Pivot Point support/resistance levels, here are the mid-Pivot

Points for the next one-month period (September-October):

- Dow 30 = 13403.27

- S&P 500 = 1443.74

- Dow Transports = 5015.78

- Nasdaq 100 = 2828.10

- Russell 2000 = 842.42

- Dow Utilities = 472.51

We'll see how bullish/bearish market action

becomes on any retest of these levels, and whether any trend reversals

materialize around them.

Googley-Eyed

I've always had a strange relationship with Google as a stock. I place thousands upon thousands of trades every year, but an entire year can go by without me trading GOOG even once. It's obviously a wildly successful company, and the stock has been a great success for long-term holders, but I personally find the chart really boring from a swing trader perspective.

In any event, in case you missed it, GOOG briefly went into Lifetime High territory earlier today. I draw no conclusions from this. It's just an interesting little event in the world of equities. When GOOG initially pegged $747, it was far more aggressively-valued from the standpoint of fundamentals, but I daresay it's more of a "value" now, especially when compared with crap like FB.