(UPDATE: I wrote this post during Labor Day, the holiday; more proof of Gartman’s power can be seen here, which happened after I wrote the post, when Gartman went strongly bearish; all the markets, of course, exploded higher immediately thereafter. It was a heartbreaker to see his bearishness in the wee hours this morning; I knew what would happen next.)

Many have made much chatter (and a fair bit of profit) about the powerful contra-indicative force Gartman’s words have vis a vis whatever market he happens to be examining. I’ve written about it myself in places like here and here, and of course ZH has had an abundance of articles and tweets that effectively provide, free of charge, one of the most powerful trading indicators man has yet devised.

I think Dennis the Menace might be on to the whole schtick however, as evidenced by this most recent interview at his perpetual forum, CNBC (a network which has provided him countless appearances for reasons we can only dare imagine). At first, it may seem like just another firm declaration which can be faded………except for one suspicious new word: may.

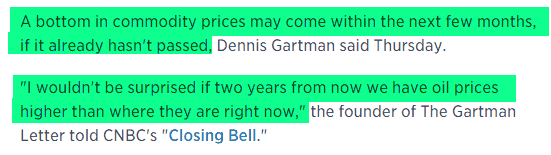

Now the text of this piece – as the late, great George Carlin might say – pisses me off. Give it a read:

It may come………within the next few months?? And he wouldn’t be surprised if oil prices were higher………..two years from now?????? What kind of analysis is this?

First of all, there are a thousand different ways to interpret this. Maybe the bottom is in. Maybe it isn’t. Maybe it’ll be in next week. Or next month. Or in six or eight weeks. And, if in the span of two years (which these days is the equivalent of a few centuries), he declares not necessarily that crude oil prices will certainly be higher (which, given the timeframe, you’d think he’d be able to put a stake in the ground) but that he would not be surprised if they were.

Well, we’re all quite relieved, Dennis, to know that you’ll be spared any consternation in your emotional makeup. I, for one, can sleep again.

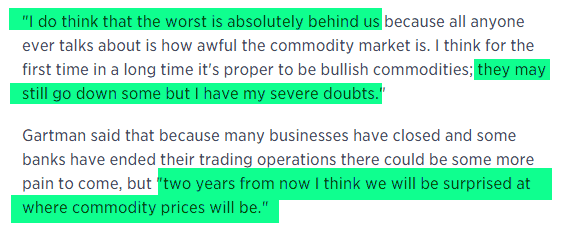

It goes on:

For a moment it seems that, mercifully, there’s an actual definitive statement being made (“the worst is absolutely behind us” – – that’s more like it!) but, in the same breath, he gores that as well (“they may still go down some”). So if you’re looking for something actionable, sorry, this is just all mealy-mouthed mush. The only clear guidance provided is that we – all of us! – will be “surprised” at where commodity prices will be (which, again, could mean anything, such as, by federal statute, all commodity prices have to be priced in bitcoin).

Truth to tell, I imagine the chap felt quite firmly that the commodity bottom was positively in, and that it was time to mortgage the children (except those that might be at a network where you want to keep showing up) and go “pleasantly long of” commodities.

But the aforementioned weasel words provide the best of both worlds: if commodities rally, then he can point to “nailing the bottom” with this interview. On the other hand, if commodities continue to sink, as I imagine they generally will, then he’s got about five different escape hatches in this verbiage so that he’s off the hook.

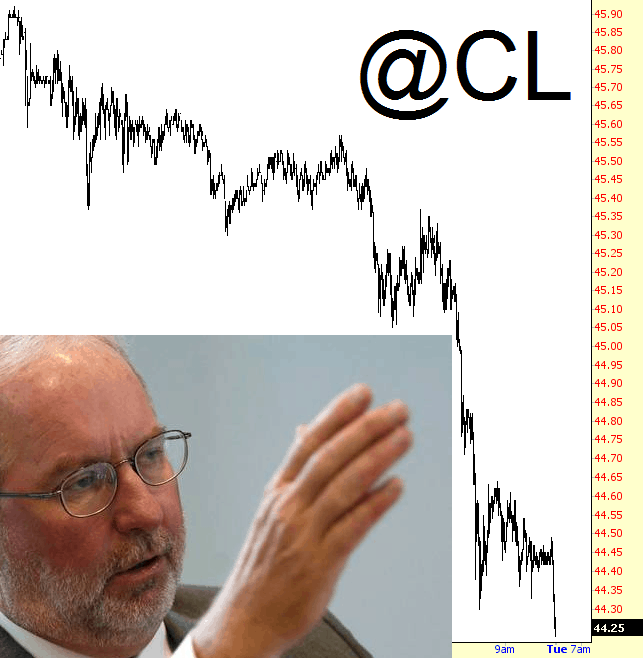

All the same, the markets have seen through all this smoke and are acting as God intended – – even on a major holiday, when most markets are completely shuttered. The power-fade-trade will always see its way clear to victory.