We’re heading for the day of reckoning, I’m telling ya. It’s all building up to something, something that can only be redeemed with fire!

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

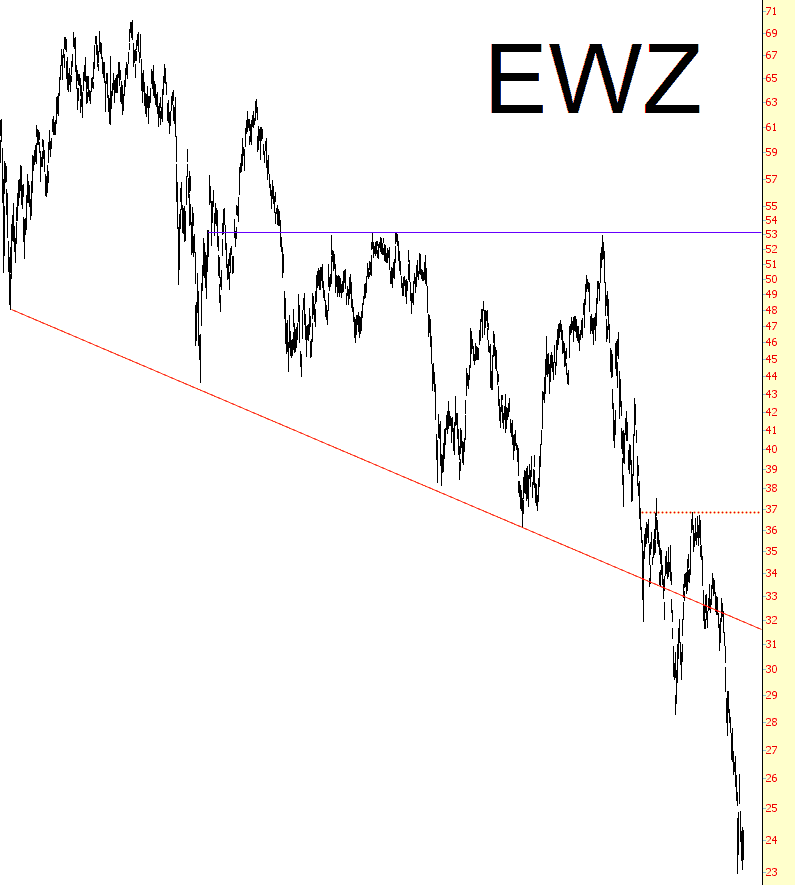

Another Blow for BRIC

Well, the ridiculous “BRIC” meme (Brazil/Russia/India/China) suffered another embarrassment after hours, as Standard & Poors has downgraded the country’s bonds to junk level (and a negative outlook, although I’m not sure what is worse than “junk”). There are probably some people out there who gobbled up EWZ since it looked so “cheap”:

My Odd Relationship with EW

I have, over the nearly eleven years (!) this blog has been around, largely avoided the topic of Elliott Waves. There is no shortage of posts here on Slope, largely by others, about the Elliott Wave theory (click here to see the list of them) but for myself, I hardly ever mention it.

One thing to understand how I analyze the markets is that I’m pretty damned lazy about using  methods that don’t “sing” to me. That sounds like an odd verb to use, but it’s the one that’s always made the most sense. The things that sing to me – – those which resonate and make sense to me – – tend to be simple tools like horizontal support & resistance levels, trendlines, and, to a lesser degree, Fibonacci retracements.

methods that don’t “sing” to me. That sounds like an odd verb to use, but it’s the one that’s always made the most sense. The things that sing to me – – those which resonate and make sense to me – – tend to be simple tools like horizontal support & resistance levels, trendlines, and, to a lesser degree, Fibonacci retracements.

I don’t go in for stochastics, Bollinger bands, relative strength indicators, moving averages, MACD, or any of that other stuff. I am awfully fond of analogs, as some of you know, but while some border on the magical (like the one I offered on Alcoa this year) others lead to completely erroneous predictions.

New Up-Leg in Yield?

As the global and U.S. equity markets stage a huge recovery rally, 10-year YIELD continues to creep higher– to 2.24% from the Aug 24 low at 1.90%– within a larger-developing bottoming pattern (outlined by the red lines below).

Current strength has propelled YIELD up and out of its near-term digestion (flag) pattern that triggers upside potential to challenge its Jan, 2014, resistance line, now at 2.40%.

Only a break below 2.11% will wreck the developing bullish set-up in YIELD.

Originally published on MPTrader.com.

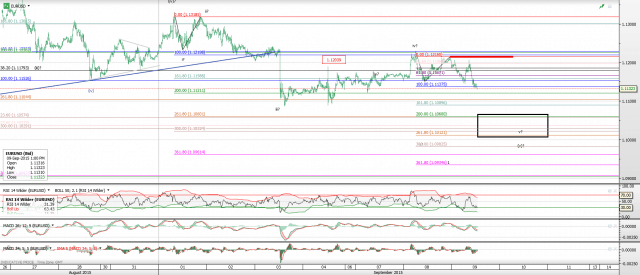

Wave 1 Down in EUR/USD

EURUSD: Move down could be a start of the long-expected wave v of (v) of 1 to (preliminary) 1.106 – 1.101 region. As long as 1.1215 signal level holds this remains my primary count.

Completion of the wave 1 is expected to provide us with a strong turn up and bounce in the wave 2. (click chart for a larger version)