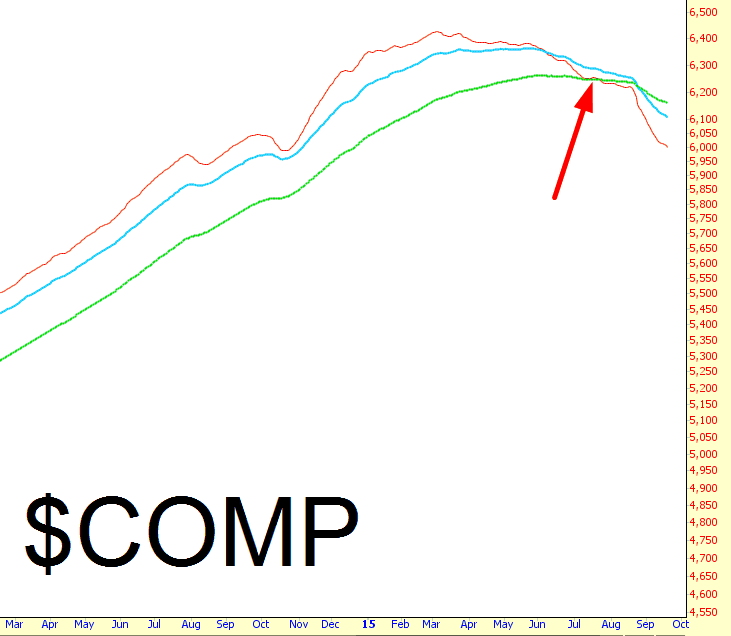

After years of waiting, I truly believe the wind is at the back of the bears now. Although I do not tend to use indicators, I glanced at some critical equity indexes to see what they were doing with respect to their 50, 100, and 200 day exponential moving averages. The crossovers seem, for the most part, to be clear and complete:

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Tempus Fugit

I’m accustomed to a smooth ride

Or maybe I’m a dog who’s lost its bite

I don’t expect to be treated like a fool no more

I don’t expect to sleep through the night

The other day, I offhandedly mentioned a beef soup I had made for my family, and a Sloper mentioned how surprised he was that I manage to do as much as I do through the course of any given week. I was touched that he pointed this out, since it hadn’t really occurred to me, and I’ve been thinking about that remark.

Is AUD/USD’s Multi-Year Down Trend Coming to an End?

Since its July 2011 top at 1.1064, the AUD/USD has lost approximately 35% of its value. Interestingly it wasn’t until June 2013 that we really started to see this move accelerate to the downside. This was due to the fact that from July 2011 until June 2013 we were consolidating in a B wave triangle that ultimately resolved very strongly to the downside in a very large ABC corrective pattern. This is an important fact as it tells that the entire structure off of the high was what we call a corrective structure in Elliott Wave Terms. This helps gives us clues as to answering the question of if this multiyear down trend is coming to an end or if we can expect further downside action to continue.

To answer this question we first need to look at the pattern and first determine if we have enough waves in place to consider the pattern complete off of our 2011 high. The answer is that for a standard corrective pattern we do not have enough waves to consider this move complete off of the 2011 high. Of course there is always the possibility that we have bottomed in a complex corrective pattern; however, when attempting to determine probabilities from a trading perspective this is a lower probability pattern and we only would consider it plausible if we had evidence to suggest that it is in fact playing out. At this point in time we do not, so we are focusing on the higher probability pattern which suggests that a longer term bottom has not been struck, thus allowing us to expect a continuation of the trend down.