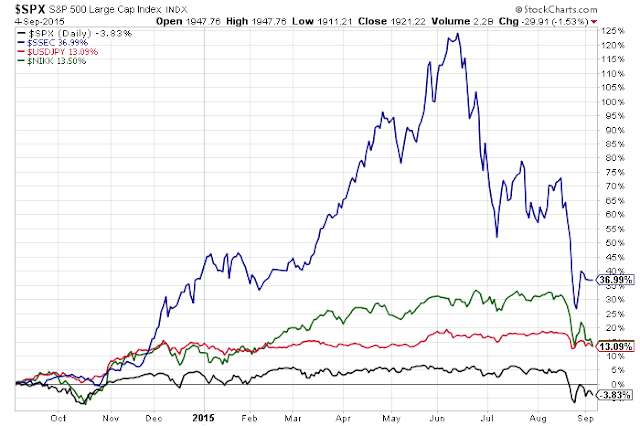

How strong is Japanese influence on U.S. markets?

Will the Shanghai Index regain strength on Monday?

Without U.S. markets opening until Tuesday, we may see an attempt by Japan’s Nikkei Index and China’s Shanghai Index to bounce somewhat. It may not become clear until Tuesday’s close as to the potential strength of any sustainable rally in these Indices, along with the S&P 500 Index. Furthermore, there are quite a lot of economic reports being released on Monday for Japan and China, which may influence Tuesday’s trading.

I’d keep a close eye on these three Indices, along with the USD:JPY forex pair, which have all traded lock-step (as shown on the following 1-Year Daily comparison chart), as to which direction the next (sustainable) breakout will occur.