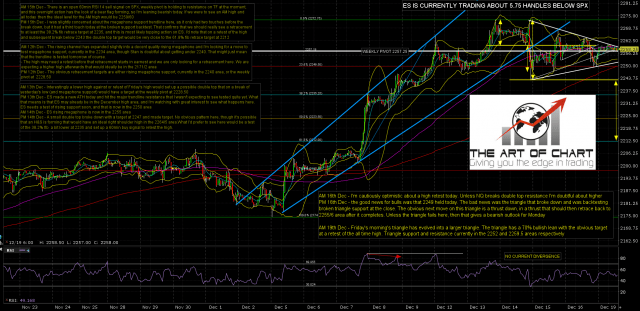

Friday didn’t go as I expected, with the bullish triangle breaking down and backtesting broken triangle support at the close. That was a distinctly bearish setup but the overnight action made it clear that all we have been seeing is since Friday morning is Friday morning’s bullish leaning triangle evolve into a larger bullish leaning triangle. That has broken up at the open today and the normal sequence here would be a backtest back into the triangle, currently in progress, and then the main triangle thrust up with an obvious target at a retest of the all time high, and then after that thrust up completes, not necessarily at that retest, the thrust should be entirely retraced back to the 2257/8 area.

If we should now see a break below triangle support, currently in the 2252 area, then something else is happening, but for now my working assumption is that this triangle scenario will play out over the next day or three. ES Mar 60min chart:

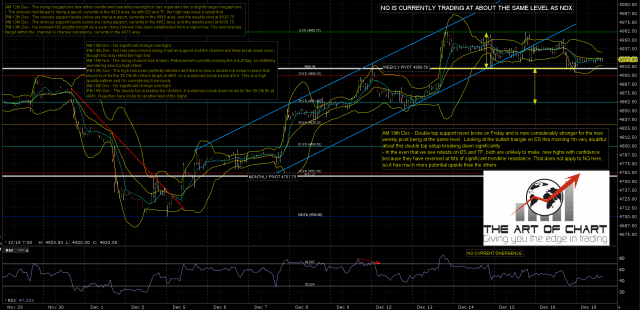

On this scenario NQ should at least retest 4960, but unlike SPX/ES and RUT/TF, NQ has not found resistance at a major resistance trendline. There is strong resistance not far above the all time highs on the other two but not on NQ. NQ could potentially therefore go considerably higher and that’s worth bearing in mind. NQ Mar 60min chart:

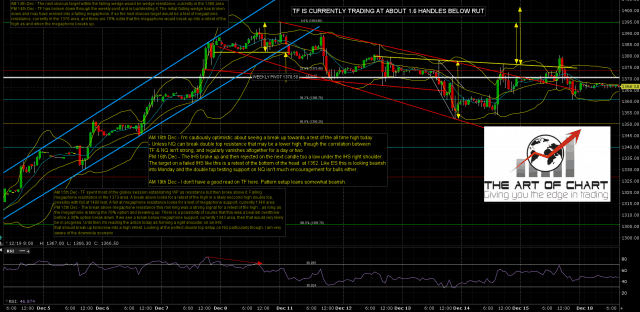

I don’t have a good read on TF here, but I would say that on this setup I would normally expect to see a retest of 1352/3 next. That obviously wouldn’t be a good fit with this ES triangle setup, and is a potential warning signal for bulls. Correlation between TF and the other two isn’t strong though and often vanishes altogether for a day or two. TF Mar 60min chart:

Christmas is on Sunday and this is very much a holiday week. Volume will be light and getting lighter as the week goes on, Obviously the tape may slow down considerably.

Stan and I did our 2017 forecasts at theartofchart.net in webinars on Thursday and Friday and the recordings for those are posted on this page here. This week’s free weekly call is posted here.