Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

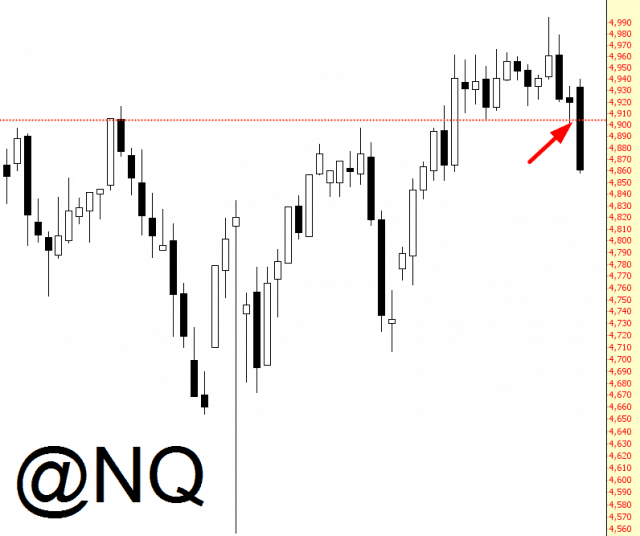

NASDAQ Breakout Failure

Goodbye to 2016

It’s been an interesting year on equities this year, with plenty of thrills and spills, and with some extremely dull periods where volatility almost vanished. Not the easiest year to trade, but generally something interesting happening, even if that was only a record-challenging period of very little volatility like the one we saw in the summer.

There were some big surprises over the year. the UK voted to leave the EU unexpectedly and the expected equities meltdown that the financial news had been talking about endlessly only lasted a couple of days. Donald Trump won the Presidency unexpectedly, and the expected meltdown that the financial news had been talking about endlessly only lasted a couple of hours. What did this mean? Mainly that watching the financial news is generally a waste of time, but most of us already knew that.

NUGT Continues to Play Catch-Up

After the Direxion Daily Gold Miners Bull 3X ETF (NUGT) satisfied our swing target of 7.00 off of the 12.15 Dec 20 lows (5.55-5.51), which represented a very important objective, NUGT’s ability to hurdle and to sustain above 7.00 argues that a more important, more powerful recovery rally is in progress.

This rally points next to a confrontation with NUGT’s Dec resistance line, which cuts across the price axis in the vicinity of 7.90 this morning.

A sustained, upside penetration of the resistance line will exhibit additional evidence that NUGT and the Miners are in the grasp of an incomplete, powerful, recovery-rally period that has as its next target zone 8.60-9.25.