Hello Slopers!

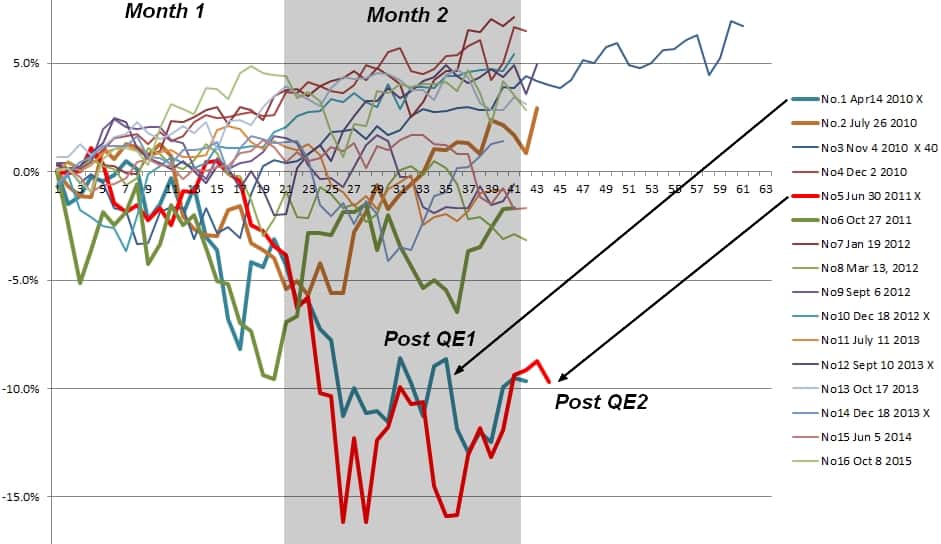

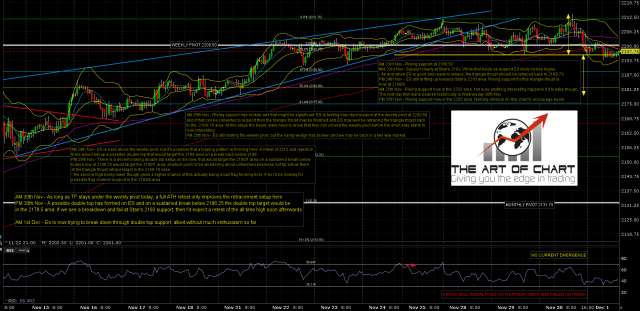

You may recall my previous post after the initiation stage of the Trump Rally here which was about a week after the election. I shared the likelihood for forward trade was in a flat to up trend, but that there was a lesser chance of a large drawdown if price did reverse. I have a little more context to it now so I thought I might show you what I’ve found.