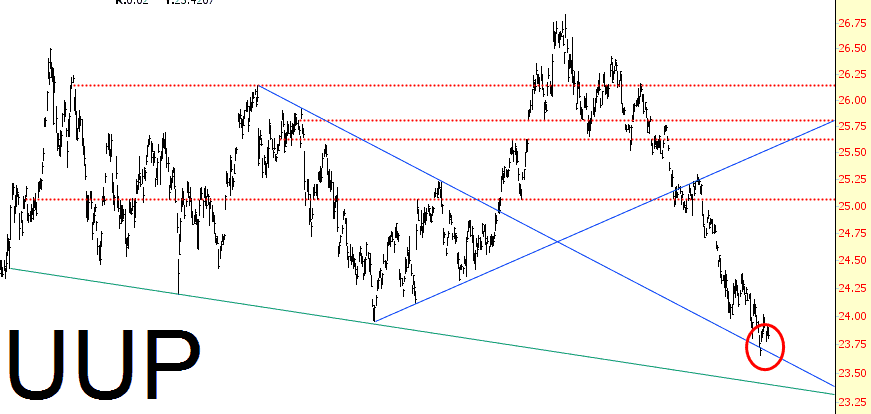

Wednesday, being the “big event” from the FOMC, is all about the dollar. The USD has been beaten down relentlessly ever since 2017 began. This is going to be a “make or break” day for the buck, since a strengthening dollar will torpedo gold (and probably help stocks) whereas a new leg in the dollar bear market will probably have just the opposite effect.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Mexico City Shaken in 7.1 Earthquake as Tepid Rally in Mexican Index Hangs in Jeopardy

Notwithstanding a rally in the Mexican Bolsa IPC Stock Index since it broke above a large, lengthy consolidation zone in mid-2016, only to retest that break at the end of the year, then rise (tepidly) to is current price of 50,265, the momentum and rate of change technical indicators have been flat since January 2013, as shown on the following Monthly chart.

The Weekly chart below also shows renewed weakening momentum and rate of change since the beginning of 2016, in spite of this attempted rally breakout.

Near-term major support sits at 45,000…medium-term at 40,000…and longer-term support at 30,000. These are important levels in the face of a new 7.1 major earthquake that struck today near Mexico City, as reported below (the death toll continues to mount as the day wears on), especially since the rally above its congestion zone has been weak. (more…)

Swing Trade UNM APC BERY

Forgotten and Absorbed into the Earth Below

For some reason I’ve been obsessed with this video, perhaps because I moved to California in 1979 and understand the feelings of thinking youth lasts forever. Give it a listen.

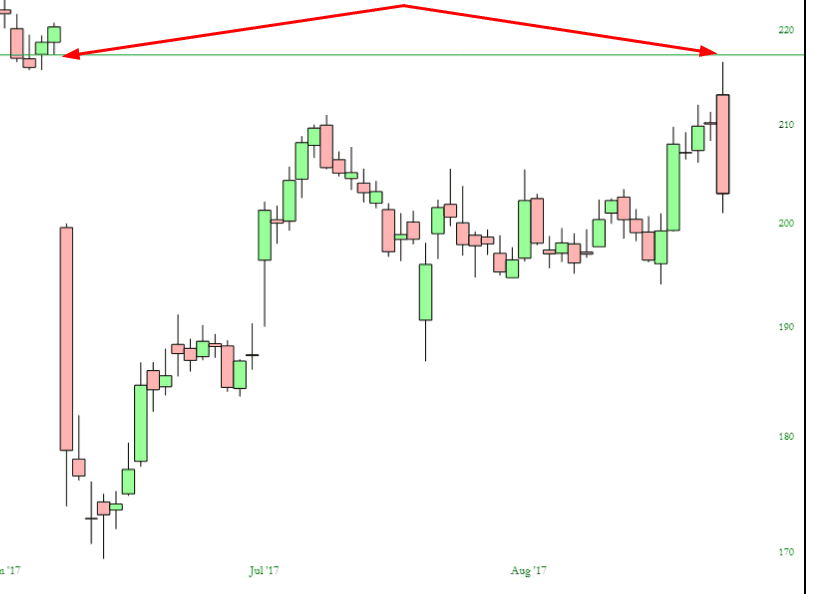

Auto Retailers Reverse Hard

This morning, the auto parts retailers opened up strong and reversed down hard, closing their gaps: