I remember it like it was yesterday. But it was yesterday……..plus nine years. That is, September 19, 2008. I was at Prophet’s office, and the CEO of thinkorswim, Lee Barba, was visiting. I had sold Prophet to Investools (its prior name) in early 2005, and Lee would come visit us from time to time to check in, share ideas, and catch up.

The market had been roiled off and on in the first nine months of 2008, and the team of Bernanke and Paulson had enough. During the trading day, several gargantuan initiatives were announced, including TARP and the banning of short-selling in about 800 stocks. (You may notice during the multi-hundred percent gain of the past eight years, no one has suggested banning BUYING stocks. But I digress).

Anyway, the reaction was immediate and ferocious. In the span of just two days, the Dow Industirals exploded 780 points higher, and with the big, bad bears banned, it seemed that Wall Street’s eleven-month dip in stocks was at an end.

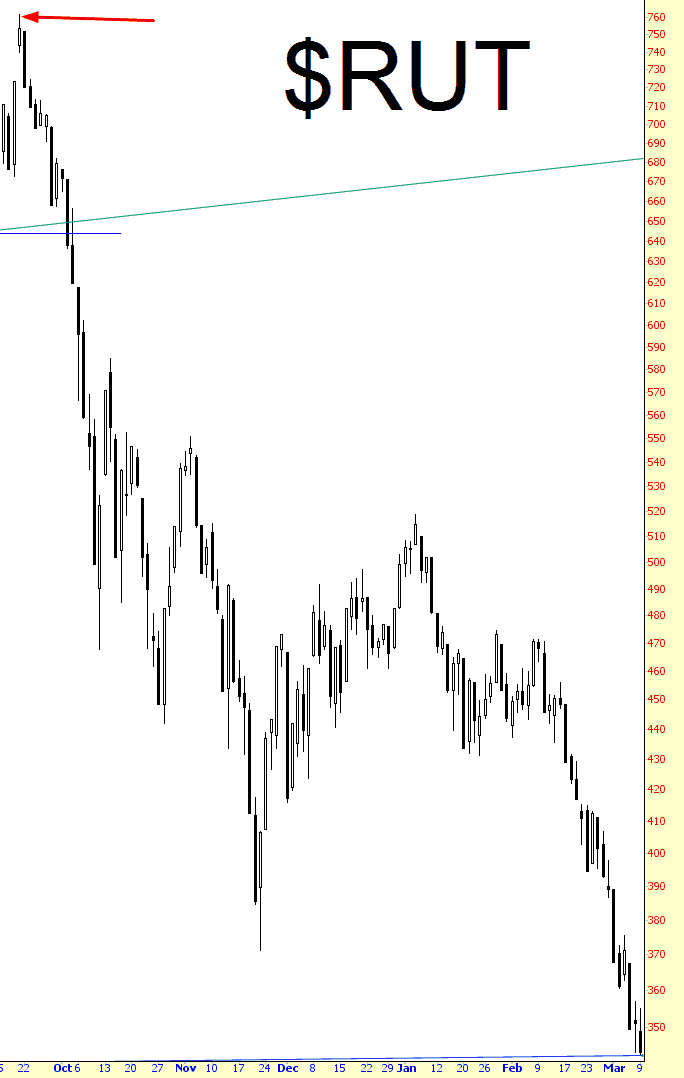

It wasn’t: