Notice a trend here? It’s hard to believe on a day like this, but keep your perspective.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

After The Intermission

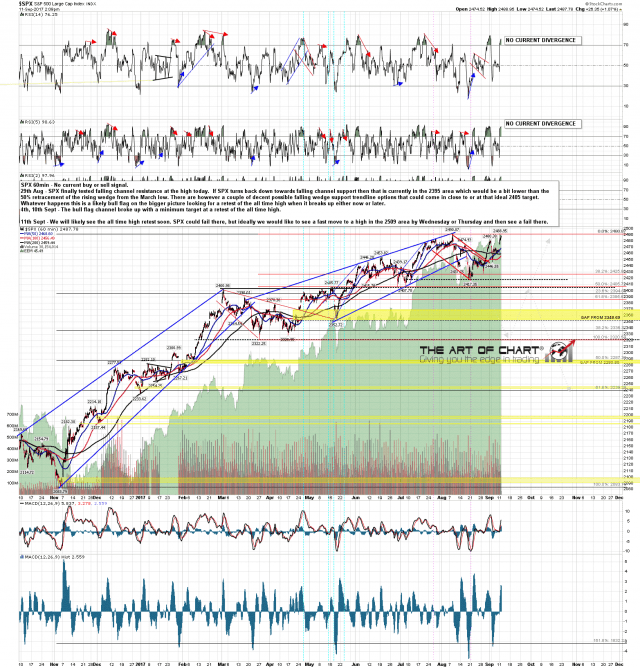

Last week was an in-between week but the key support levels all held, and after the strong open this week SPX is now close to the bull flag target at the retest of the all time high. I show below that another bull flag channel has now also broken up on NQ, and I’m expecting an all time high retest there as well. SPX 60min chart:

Five Stocks Poised for Breakouts

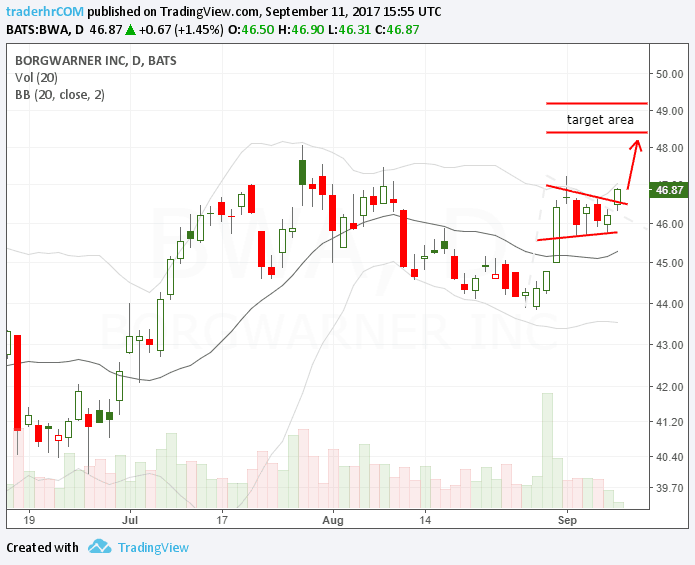

BorgWarner Inc. (BWA)

(more…)

(more…)

“Shock Event” for 3 Top Insurance ETFs

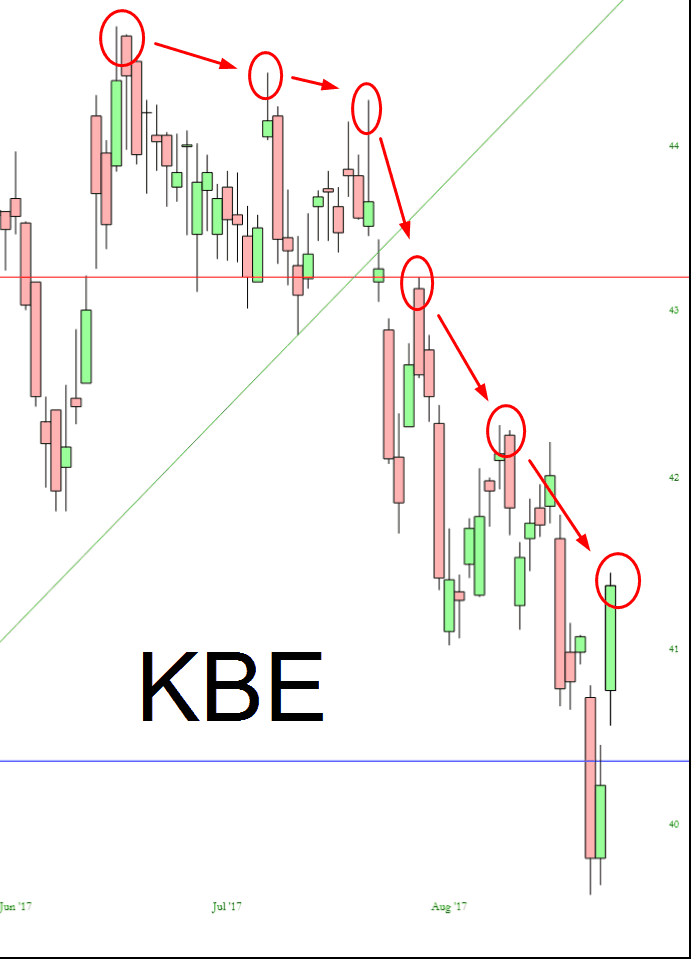

Price on three top Insurance ETFs has been dropping since mid-August, as shown on the following Daily charts of IAK, KBWP and KIE. In the process, they made some extreme lower swing lows on each of their respective three technical indicators, suggesting that further weakness lies ahead.

As of Friday’s close, they are trading around their 200-day moving averages, so failure to regain an upward bias from that level could spell further sharp drops for these ETFs. Watch for any major volume spikes on further weakness to indicate possible panic selling. In the short term, we may, first, see a retest of their 50-day moving average (possible “Dead Cat Bounce”) before the next leg down occurs. (more…)

Irma Bombeck

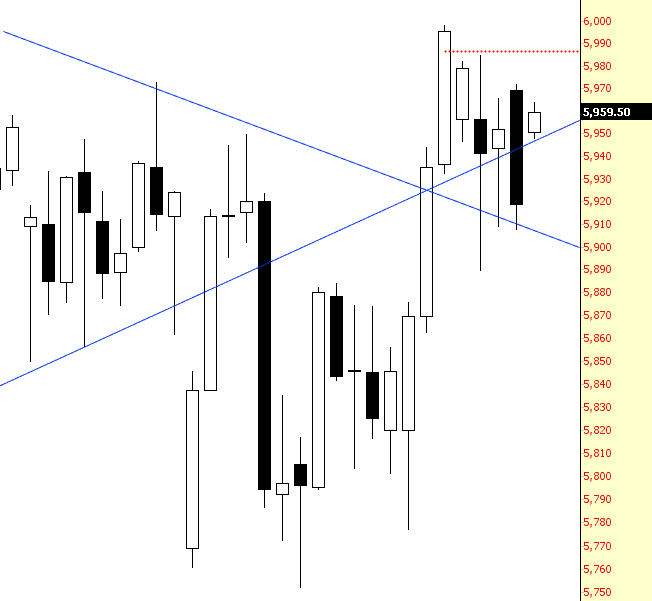

The “nuclear” hurricane Irma is grinding its way into extinction, and already the teeth-gnashing and chest-grabbing about what an apocalyptic storm it would be is fading just as fast. Damage estimates look to be about four times as big as reality. Not to say that it wasn’t a nasty storm, but the markets are rallying on the NQ up 43 points (as of this moment):