It wasn’t that long ago that when I felt like it was a good time to buy gold (that is, real gold you could hold in your hands), I would go out and buy some. But after a while, gold wouldn’t be doing that well, and I’d sort of realize that there was really no scenario in which it would be useful to me (e.g. there would never come a day that everyone was starving since Whole Foods would ONLY accept gold, and I’d be able to feed my family due to my good planning). So I’d dump it.

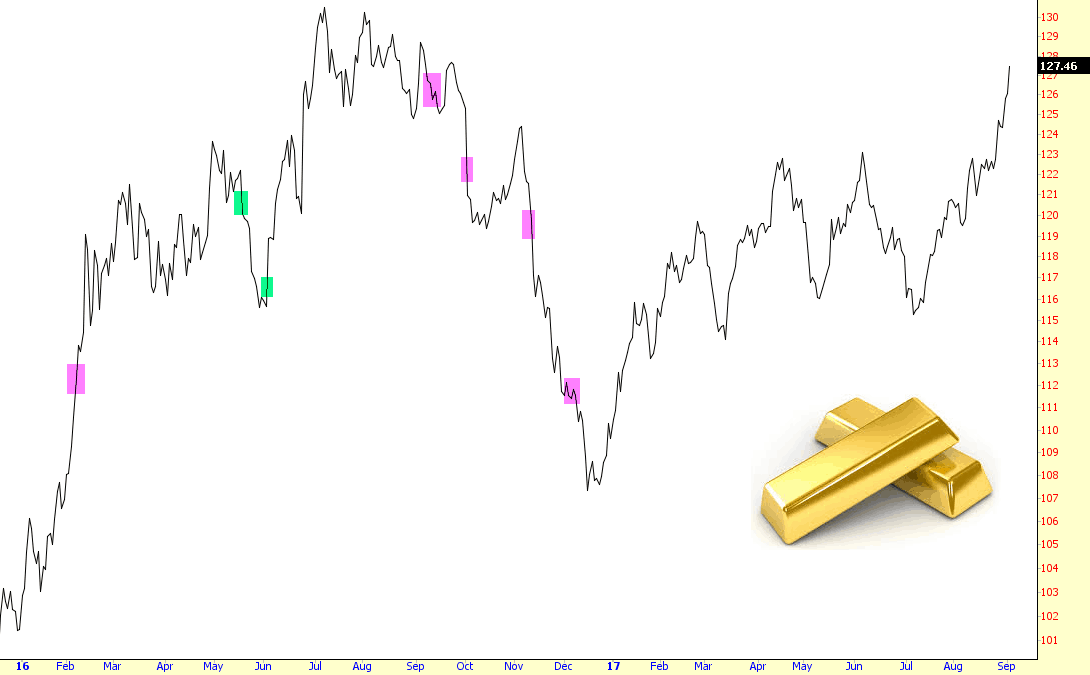

I thought I’d show when I bought and sold bullion, thinking it would reveal Gartman-like levels of bad timing. It turns out it wasn’t THAT bad. It was sort of bad – – buffoon level, I guess – – but nothing horrendous. Below I marked in green the buy points and in magenta the sell points.