I keep looping back to the word “annoying” to describe the market, and that still seems to fit. The goddamned thing just won’t go into a freefall. To be clear, I had a good week, but good God almighty, it’s way too much work. Market Gods, throw me a bone here! Give me a morning where the ES is down 50! Do it for the Timster.

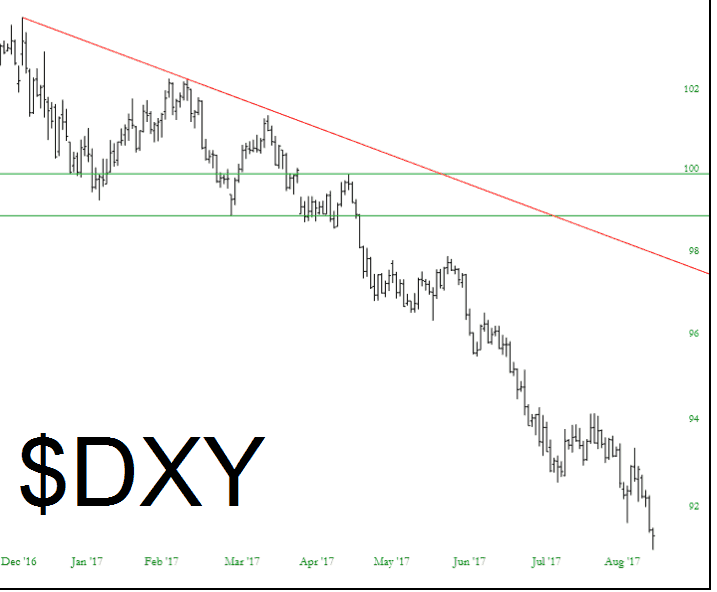

Anyway, one big theme all year long has been the US dollar’s steady progression from (1) mega-powerful currency to (2) quilted toilet paper. I suspect this trend will continue as Trump continues to bungle his way through his only term.

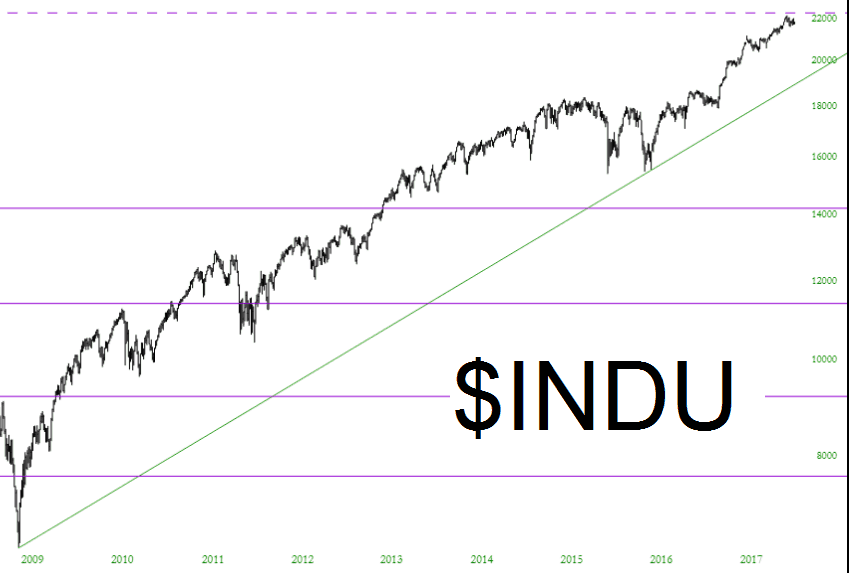

As for equities, they have hopefully peaked, and they’re just kind of floating in mid-air right now, waiting for another shoe to drop. Even if it respects its ascending trendline, the Dow still has multiple thousands of points between present price levels and principal support.

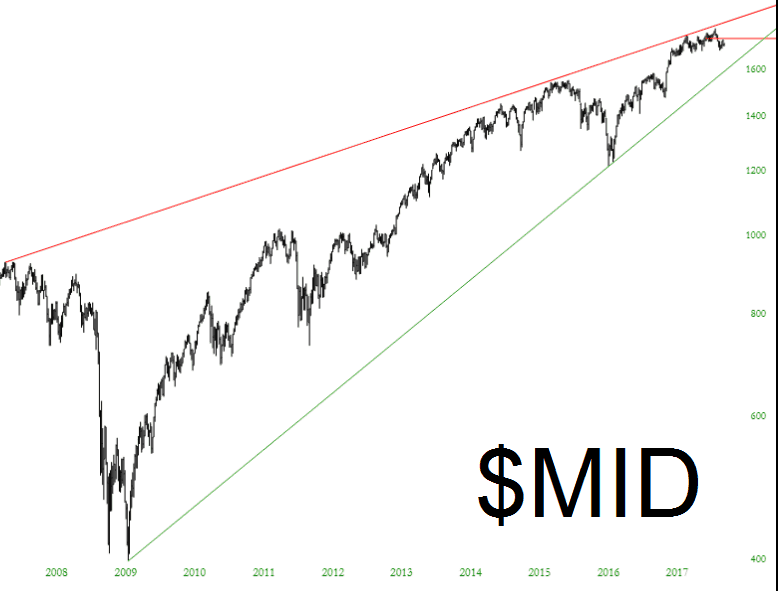

I’m more inclined in my own trading to the looks of the MidCaps……..

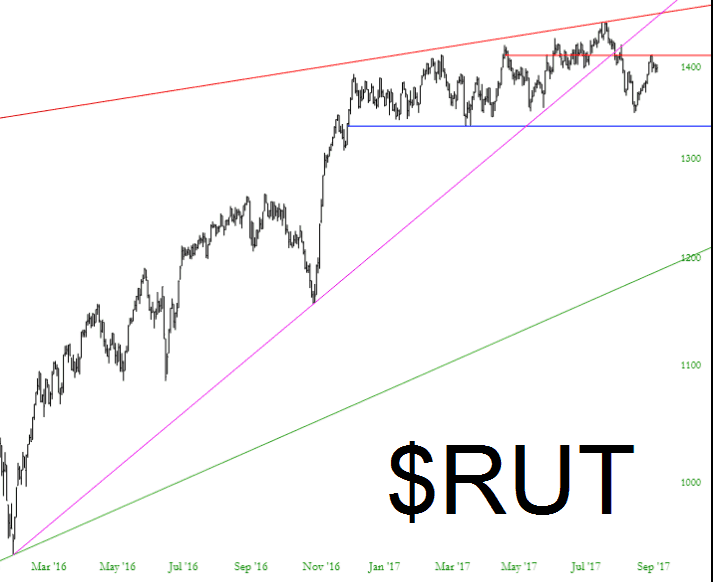

……and, even moreso, the Russell 2000 small caps. Indeed, I’ve got October 20th puts on IWM and November 17th puts on $RUT itself.

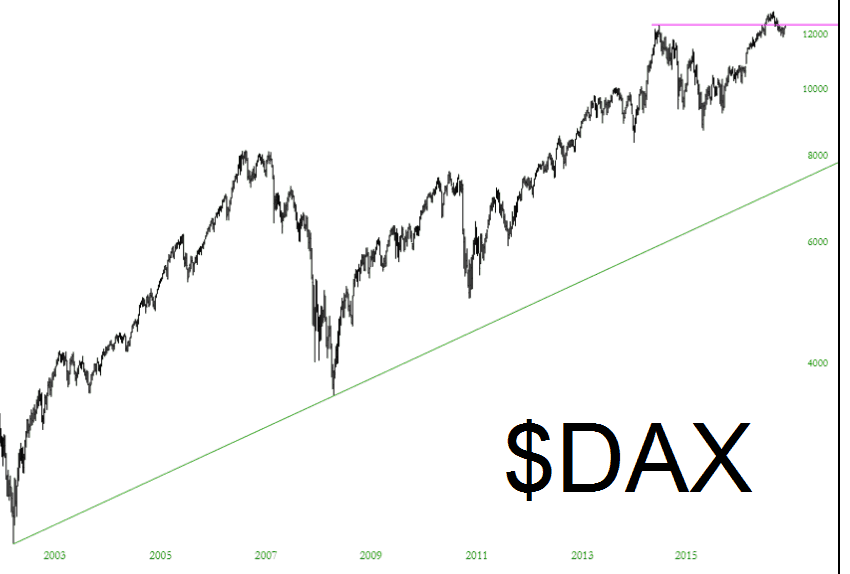

I also want to mention that major international markets, such as France and Germany (the latter of which is shown below) are sporting failed bullish breakouts. This nurses my long-dashed hopes of a honest-to-goodness bear market commencing.

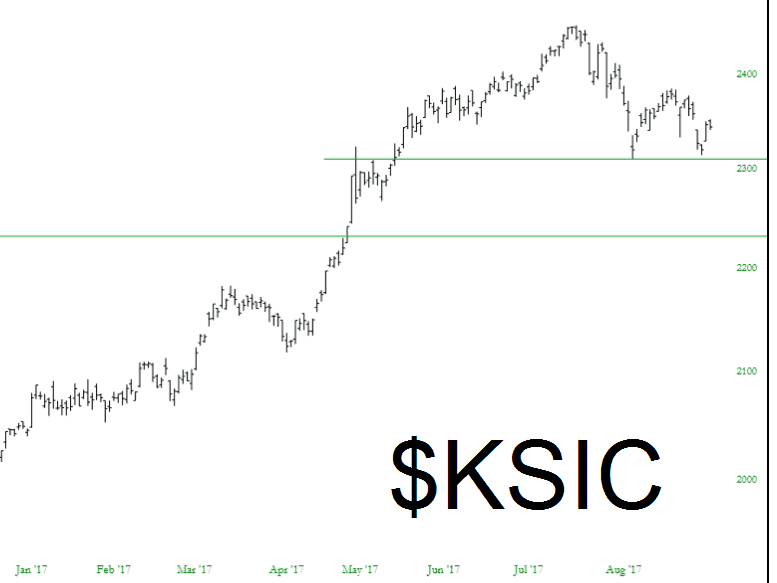

Finally, we turn our attention to South Korea (as Mr. Kim does from time to time). It looks to me like a beautiful top is forming. Gosh, I wonder what on EARTH could disturb the tranquil prosperity of this successful nation? Maybe an insane lunatic with nuclear weapons just fifty miles from its largest city? Nahhhhhhhh……….