Time once again for a review of the big picture, because… perspective. For example, in my mind I feel that training has been done to not expect a real whopper of an inflation trade. That was from the conditioning of the global deflationary force, post 2007. Yet the technicals for industrial metals are bullish for more upside, as you’ll see below.

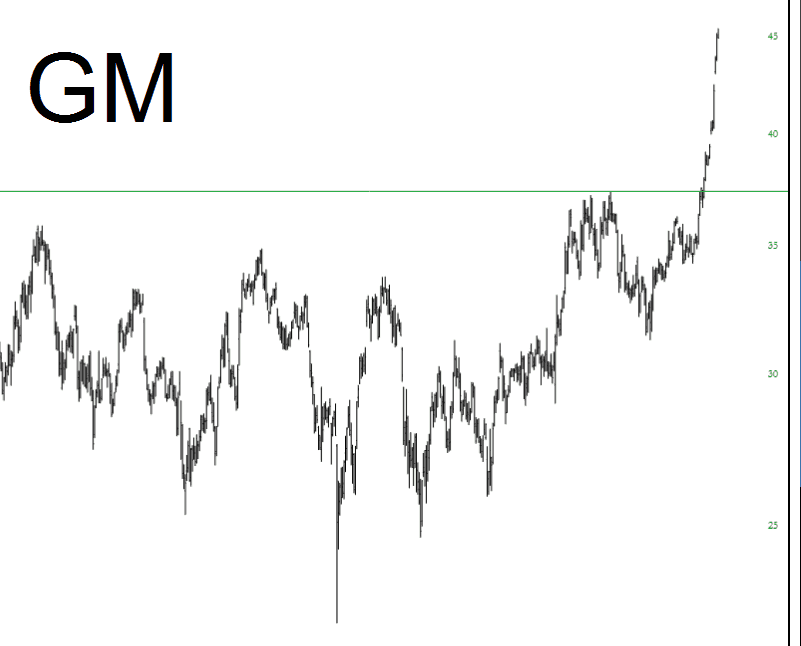

Anyway, here are big picture monthly charts with limited word interference from me (and hence, not comprehensive analysis). It’s just for your own individual reflection if you’re even into this stuff like I am. (more…)