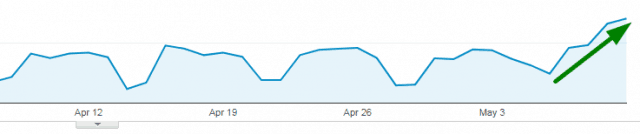

Preface from Tim: one “bullish breakout” I really like is SlopeCharts usage (shown below), which has been steadily climbing since we launched the new site last weekend. Please note clicking on any of the hyperlinks in this post will bring up its chart, and also remember that preceding a ticker symbol with a “$” in the comments section (example: $FB) will provide a hyperlink in the same manner.

Here are five momentum stocks making a move primarily on earnings.

Arrowhead Pharmaceuticals, Inc. (ARWR) jumped $1.25 to $9.00 on 5.6 million shares Wednesday, almost four times its average volume. The drug developer reported fiscal second quarter earnings on Tuesday that matched Wall Street expectations. The move broke the stock out of a two-month coiling consolidation. At its intraday high of $9.60, the stock got up to resistance at the rising trendline before backing off. A breakthrough there could lead to $13.

Endocyte, Inc. (ECYT) rose 95 cents to $12 on 1.4 million shares. The development-stage biopharma company yesterday posted a narrower-than-expected first quarter loss. The stock last week broke out of a six-week coil and pulled back slightly on Tuesday, but Wednesday’s advance took it right up to its next lateral resistance area. The stock hasn’t been at this level 2014, and the long-term chart shows a target of $18, where the stock resided just before breaking down in April of that year.

Legacy Reserves LP (LGCY) gained another 71 cents to $7.20 on 1.2 million shares traded Wednesday, more than double its average volume. The oil and natural gas producer has seen its stock advance from just above $1 in December 2017. After a brief consolidation in late April, the stock recently broke out again. The company reported first quarter results on May 2, including the addition of 20 wells online late in the quarter. Next targets are $8 and then $10-11.

Impinj, Inc. (PI) gained 69 cents to $18.09 on Wednesday on 1.7 million shares traded. On Tuesday the stock popped 30% as the maker of tools and equipment for tracking real-world goods reported first-quarter results that were viewed positively. Tuesday’s move broke the stock out of a three-month consolidation, and now the stock is approaching its February 1 pre-breakdown high near $22.50, the next target.

PolarityTE, Inc. (COOL) added 27 cents to $23.38 on 573,900 shares traded Wednesday. The tissue engineering company announced it is hiring dedicated sales representatives on the East Coast to accelerate the regional market release of its SkinTE product. The stock, which rose for the 7th day in a row, backed off from its intraday high of $24.64, and could consolidate in this area before its next move up. A move through lateral resistance at $25.50-.75, last reached in February, could lead to $30 next.