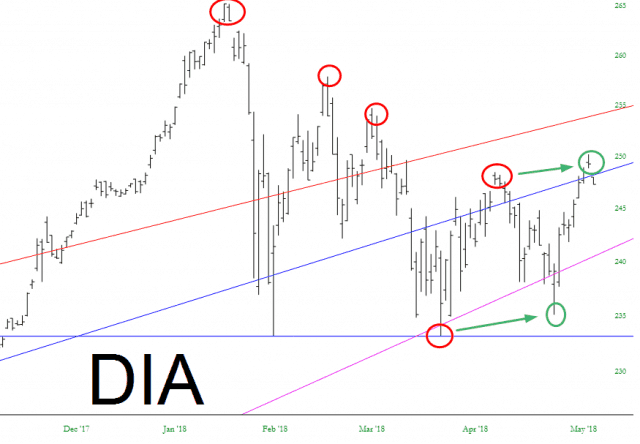

Today was a pretty interesting one. One bit of bleakness, in spite of the dip on the Dow, was that we’ve got a set of higher highs and higher lows, as I’ve illustrated below with the arrows. I’m hoping this is a one-hit wonder and not a trend change, but – – – them’s the facts.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

The Hideous Glasses Aren’t Helping

I did my first Kicked in the Spectacles post on October 14 2017 and followed up with a second (which, in a not-very-creative moment, I gave the same title) on April 26 of this year. Although I am not privy to details of how these goddamned hideous things are selling to idiot millennials, something tells me that this product launch is another utter catastrophe and is hastening the day that SNAP is a single digit stock (whose digit, one day in the future, may well be $0).

Thus, Evan Spiegel’s company has DESTROYED $25 billion shareholder value (with $13 billion to go). But it’s not like this is going unpunished. Evan is still a MULTI BILLIONAIRE and is forced……….FORCED, I tell you!……..to go to bed with his gold-digging wife every single night, shown below. So it’s not like retail bagholders who were taken in by this disaster can’t take comfort about Evan’s desperate, heart-rending situation.

The Backtest Before The Retest

A couple of announcements today. We did our monthly public Chart Chat on Sunday and if you missed that you can see the recording on our May Free Webinars page. We are doing a free webinar on Thursday after the close looking at our new directional Paragon Options service trading options on futures, and if you’d like to attend you can register for that on the same page. We finished our first Academy Trader Boot Camp course last Friday and the feedback was very positive. If you’d like to see some of that then scroll down to the bottom of our Testimonials page to find those. We’re planning to do these regularly and the next one starts next week so if you’d like a very reasonably priced and high quality four week course on TA, risk management and trading methods, you can register for that here.

On SPX the retracement we have been expecting is in progress and, since I recorded the premarket video below, is now testing the first main target area at the ES weekly pivot at 2704/5. There is decent support here, but I was noting on the video that there are some decent looking hourly RSI 14 sell signals that have fixed on SPX, NDX and RUT that are suggesting a break lower, and as of now, none of those sell signals are close to even the possible near miss (RSI) targets. Partial Premarket Video from theartofchart.net – Update on ES, NQ and TF: (more…)

Stumbling Down the Stairs

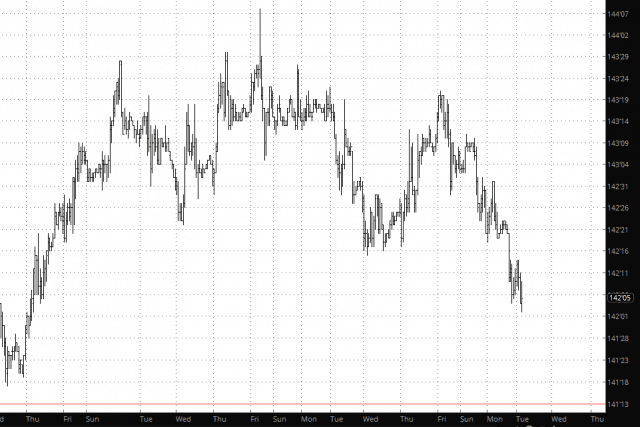

I can hardly remember the last time I woke up to a red NQ, red ES, and red ZB (bonds). I think it was about thirteen or fourteen years ago. But it’s a delight to hold, and of course I’m grateful to the obvious impetus behind this move.

In particular, the weakness in bonds is key (as you well know by now). Here’s the close-up view, and as I’m typing this, bonds are down about six-tenths of a percent.