Hello, Slopers. I’m typing this late on Tuesday night. At the risk of unnecessarily embarrassing myself, I’ll go ahead and apologize for having some downtime Tuesday evening. Not to drill down into the gory details, but we were upgrading our security certificate (SSL) since we have a few “edge” cases (like folks on mobile phones) where the SSL wasn’t working. Well, a nuclear bomb pretty much went off, and after some very intense work, we were back in business again. But I deeply apologize for anyone who was wondering where the site was Tuesday night.

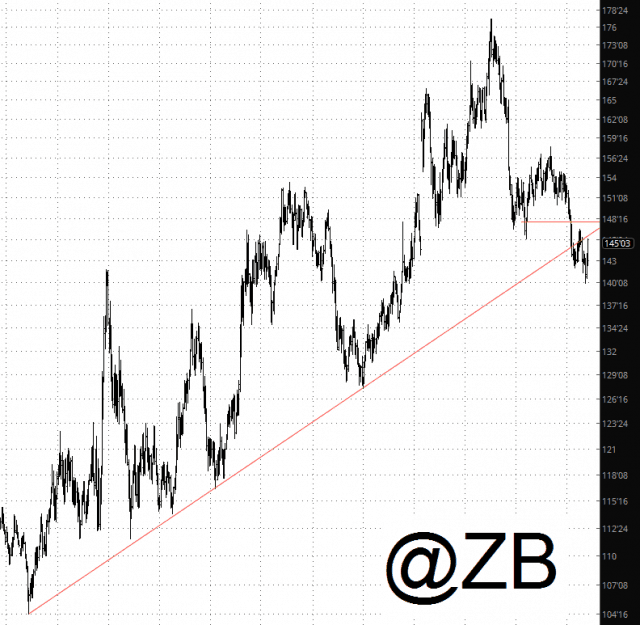

So as for the markets, what’s absolutely crucial is bonds. I keep saying that, I know, but it’s only because I believe it so deeply. As horrible as the past week has been for bond bears like myself, NOTHING has altered my big picture view. The topping pattern is huge, and the long-term trendline is broken. Period. End of story.