OK, I am deliberately poking him at this point.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Is It Time To Just Sell All Your Gold?

For those that follow me regularly, you will know that I have been tracking a set-up for the SPDR Gold Trust ETF (NYSEARCA:GLD), which I analyze as a proxy for the gold market. I also believe that gold can outperform the general equity market once we confirm a long-term break out has begun, and I still think we can see it in occur in 2018. This week, I will provide an update to GLD.

While I have gone on record as to why I do not think GLD is a wise long-term investment hold, I still use it to track the market movements. For those that have not seen my webinar about why I don’t think the GLD is a wise long-term investment, feel free to review this link for my webinar on the matter.

Now, to answer the question I presented in the title to my article, I will simply say HECK NO! In fact, now is the time you want to be setting up your long positions, as we have a reasonably low-risk set up presented before us.

Over a week ago, I wrote my most recent public article on GLD, wherein I presented my general perspective, which was outlined in much more detail to our members, with specific charts:

“As long as the GLD remains below 126, I still see the potential for it to test the 122/123 region.”

What Support Means in Human Terms

I was recently asked a question on Quora (“What does support level mean in a technical chart of a stock?“), and after I finished answering it, I realized it was way too long not to share here. So here it what I said:

Although I’m a chartist, I will answer this in “human” rather than chart-based terms. I’ll use a rather facetious example to make my point.

Let’s say a given stock X traded between $50 and $51 for two solid years. Countless people bought at that price. It was boring but very, very stable.

Now let’s say for whatever reason the stock vaulted swiftly over the course of a month up to $80 per share. Perhaps there were takeover rumors or optimism about a new product line. So now you’ve got a huge mass of people with nice fat profits, as well as some newcomers who paid between $51 and $80 for the same stock.

So now you have two classes of owners – – a large mass of folks with a good basis price and big profits, as well as newcomers whose profits range from decent to very small, depending on the price they paid. This latter group is going to be quite nervous and have weak hands. The former group will be more confident, since they have a much lower basis and have grown accustomed to the stock never being below $50. (more…)

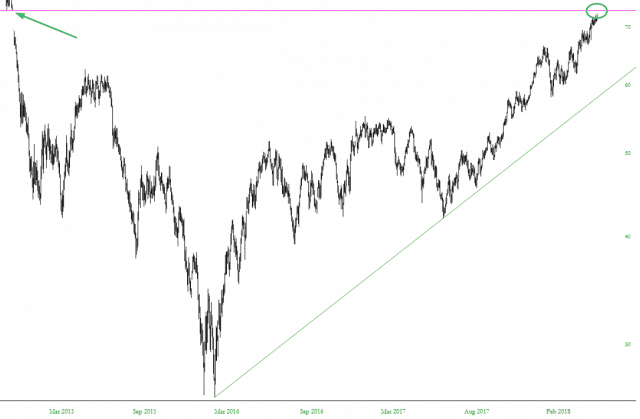

Close Enough

I’ve been watching the gap in the long-term crude oil contract for a long time. The value is at $73.25. We got up to about $73, which is close enough for me.