If you think I ever stop thinking about Slope, just look at the side of my pool. As I am doing laps, whenever I have an idea, I grab a chlorine tablet and scrawl it on the side. By the end of my little workout, I’ve usually got a bunch.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

The Ceaseless Ascent

Well, I’m glad the site is doing so well, because the markets over the past week have made me feel pretty lousy. It’s nice to at least have Slope humming along to comfort me.

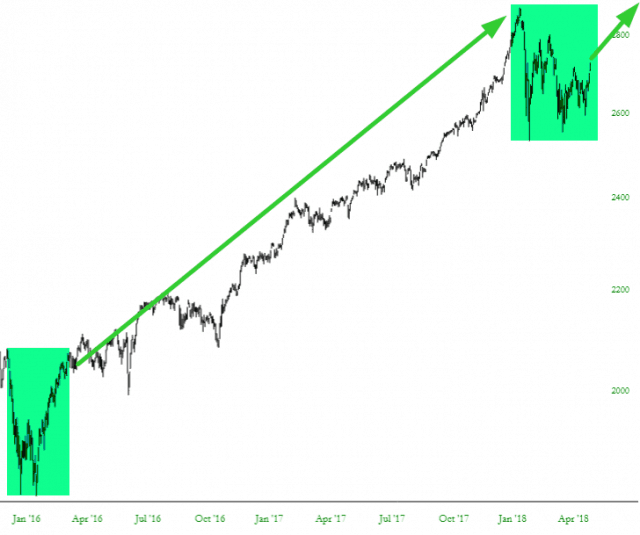

I’d like to offer the following off-the-wall musings as a very different take on the market. It’s a disposition that many, many people share, and perhaps it would help me get in sync with the rest of the planet to actually type what everyone else is thinking. I submit this to be neither facetious nor wry. So here goes.

(1) Just as humanity as made sufficient advancements in technology to, for example, feed everyone on the planet, so, too, have we reached a sophistication in knowledge and financial management rendering bear markets permanently extinct. Yes, there will be occasional dips from time to time (see green tints), but these will swiftly be pushed aside by a new ascent. If a solid decade of evidence isn’t enough, I’m not sure what is.

Facebook’s Full Recovery

It’s quite evident the Facebook privacy scandal, which garnered worldwide attention and lengthy Congressional hearings, is now a minuscule footnote in history. Nobody cares.

Breaking Triangle Resistance

Our monthly free public Chart Chat is on Sunday, so if you’d like to register for that, you can do that on our May Free Webinars page.

SPX found support on Tuesday as expected, and is now testing the next level of resistance at triangle resistance on SPX. We’re expecting a retracement soon and I was hoping to see triangle resistance broken clearly before that retracement, to make the next retracement low an unambiguous buy, and my wish has now been granted. So far the day is looking trendy, so we may not see the high into that retracement today. Partial Premarket Video from theartofchart.net – Update on ES, NQ and TF: