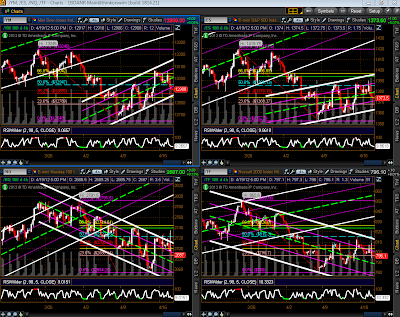

You can see on the 4-Hour charts below that, from their March high to April low, the YM, ES, NQ & TF are still trading within their Fibonacci retracement zone. All of them are below the 50% level, with YM as the strongest, followed by ES, NQ, and TF, respectively.

The YM and ES have formed an uptrending channel from the low, and price is still trading within it after Thursday's close, although the YM pierced briefly below in Thursday's trading.

The NQ and TF are still trading within a downtrending channel from high to low, although the NQ pierced briefly above in Thursday's action, and the TF is attempting to form an uptrending channel.

I mentioned in my post of April 17th that I'd be looking for a continuation of Tuesday's advance and a hold above its high on any retest before I would assign a "bullish" rating to all four in the short term. Since that hasn't happened, we'll have to see whether we get more choppy sideways movement, or a resumption of the pullback below the low of the Fibonacci retracement, or whether we see price stair-step upwards to break and hold above Tuesday's high, before a new trend is eventually established on a Daily timeframe. I'd re-iterate that should this third scenario play out, I'd like to see high volumes support such a move, particularly on any breakout and hold above April's high, especially with respect to the NQ (for the reasons I explained on April 17th).