My buddy Steve “Slim” Miller just sent this to me to share with Slopers:

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Lucky Lucky Girl

Over the past 15 years, Yahoo (YHOO) has lost nearly 70% of its peak value (and this is taking into account its utterly and completely lucky gains from Alibaba). During those fifteen years – – and let’s remember, on the day of Yahoo’s price peak, Mark Zuckerberg was a 15 year-old high school student – – Yahoo has struggled mightily to recapture its lost glory, only to fail again and again, in spite of a series of blonde female CEOs whose principal difference appears to be whether they use profanities in public or not.

As a person who has been online since 1981 (literally), I have a strong sense as to what’s good and what isn’t so good, and I’ve always thought Yahoo sucked out loud. It’s astonishing to me that they are ever still around. And, in a way, they are not, because their enterprise value was recently calculated as negative thirteen billion dollars.

Credit Markets in Distress

It is no secret that US credit markets have been increasingly stressed lately. Junk bonds are tanking and junk’s ratios to the relative quality of Investment Grade and Treasury have as well.

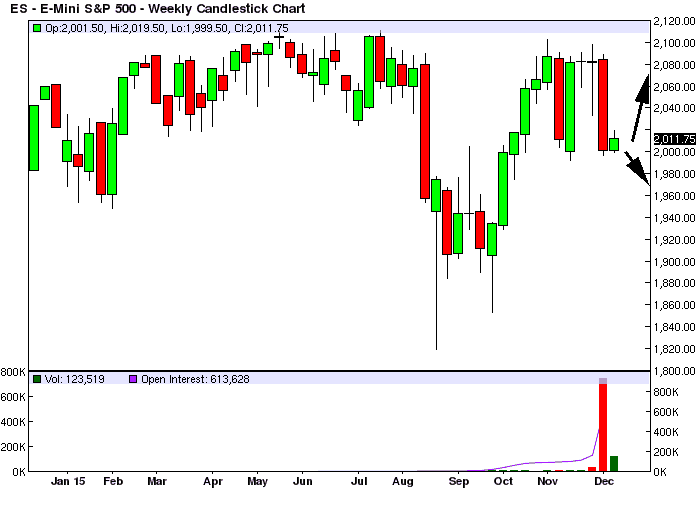

ES Long? (by Retracement Levels)

The ESH16 market last week closed down, losing about a 100 points in value from the previous week’s highs. Looking at the ESH16 WEEKLY chart below you can see that the price trend, after recovering, faltered. What have we learned from the last few months? That after a correction there is a mass of buyers ready to step in and push prices back up to the previous top in the ~2100 price area, but as soon as the price reaches that zone the buyers disappear and the market tanks again. Very interesting.

The next valid WEEKLY resistance, according to our quantitative models, is at ~2074, and next valid WEEKLY support is at ~1979 (OVERSOLD).

If there is an attempt to rebound from current levels, the market will encounter WEEKLY/MONTHLY resistance in the ~2074/2166 area, according to our models. There it would be reaching the end of any uptrend, we are not at a major market bottom from where the upside can be considerable.

In short, this means: a rebound is possible soon, but the upside is capped at around ~2100.