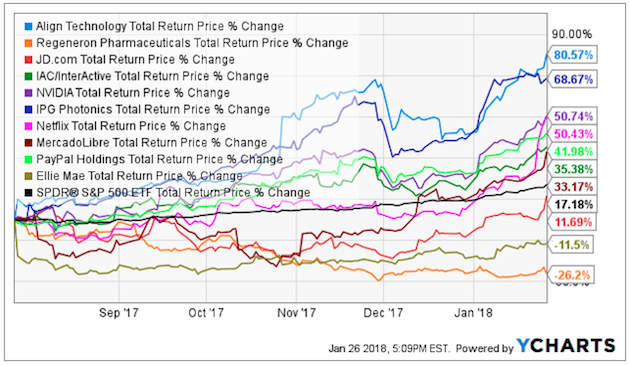

The 6-month performance of Portfolio Armor’s top names from July 27th. (more…)

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

What’s Hot & What’s Not in US Markets

Depicted on the following graphs are percentages gained/lost in Major Indices and Major Sectors over a longer term (1 year), a medium term (year-to-date), and a short term (the past week).

They are presented, simply, to illustrate where they are relative to those three timeframes.

My only comments are as follows:

- Major Indices: Utilities, Small Caps and Transports continue to underperform, and I’d monitor Small Caps, in particular, as I outlined in yesterday’s article, for further signs of weakness and an indicator of further equity risk-off activity.

- Major Sectors: Energy, Consumer Staples, Health Care and Utilities continue to underperform, but I’d keep an eye on Financials for any evidence of further weakening, as I recently described here.

Trendline Evolution At Work

There has been a remarkable similarity on the patterns from last Friday’s low on all of ES, NQ and TF, with rising wedges forming, then breaking down. I was expecting consolidation to establish less steep support trendlines and in a remarkable convergence all three of those initial rising wedges evolved into perfect rising channel with the channel support trendlines established at the premarket spike down lows this morning. Will these make it back to channel resistance? Maybe yes, I look at options in the video below. Intraday Video from theartofchart.net – Update on ES, NQ and TF: (more…)

Four Stocks to Watch on Technical Momentum

Earnings news and strong technical momentum are powering these four stocks.

HTG Molecular Diagnostics, Inc. (HTGM) jumped 10.6%, or 43 cents, closing at $4.48 on very heavy volume of 3.4 million shares traded. The move came as the company, which provides instruments, reagents and services for molecular profiling applications, presented at an industry conference. This stock has great price action. It exploded up to $4.69 on Monday, then fell to $3.82 on Tuesday before bouncing back up again to close at its high for the day. If price moves beyond $4.70, a move up to $5.30 may come very quickly.

Mimecast Limited (MIME) soared to a new all-time high of $35.05 intraday before closing up $1.02 at $34.24 on extremely heavy volume of 1.3 million shares traded — more than four times its average volume. On Monday the London-based data security company reported earnings that topped Wall Street expectations, and on Tuesday it announced it has moved its North American headquarters to a larger office to accommodate rapid business growth. Next target: $38. (more…)