I had a recent experience with Slopecharts that I wanted to share, since it is illustrative of how some very simple functions built into the program can produce powerful results.

I have a watch list called ETFs which contains 80 symbols of popular ETF symbols like SPY, TLT, QQQ, and so forth. Because these instruments have been so important to my trading, I wondered to myself if there were other interesting symbols that I wasn’t yet following.

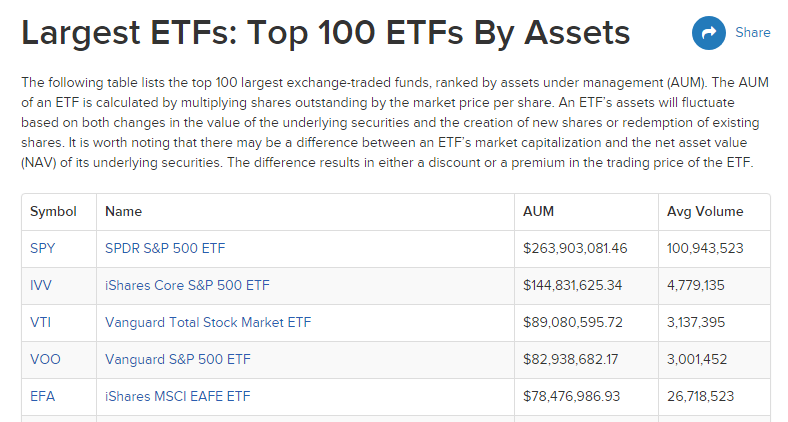

One Google search later, I was on a page that had the biggest 100 funds, and I simply copied this table text and pasted it into Excel.