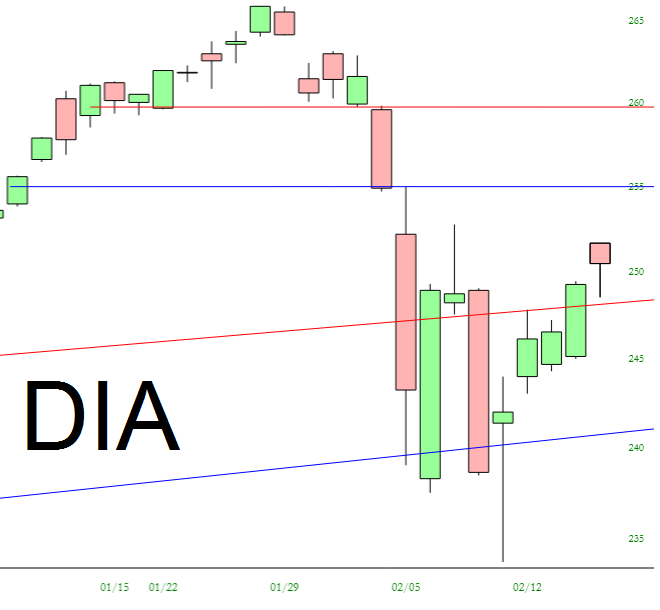

In the depths of the selloff last week, I decided the counter-trend bounce would get to around 2740 on the ES and “the low 25000s” on the Dow. Well, both of those have been achieved. In spite of the counter-trend rally matching my targets, it still makes me very uneasy. It seemed that earlier today (Thursday), the selloff was resuming, but that weakness vanished, and we are at a place now where, frankly, one more strong day would cause some real harm to my confidence.

There isn’t any big news coming out on Friday, but with five solid days of powerful upthrust, the momentum is definitely on the side of the bulls. If it keeps up, I’ll just dial back on the shorts. I hope not, though; I’ve got plenty of great setups I’d love to put into motion.