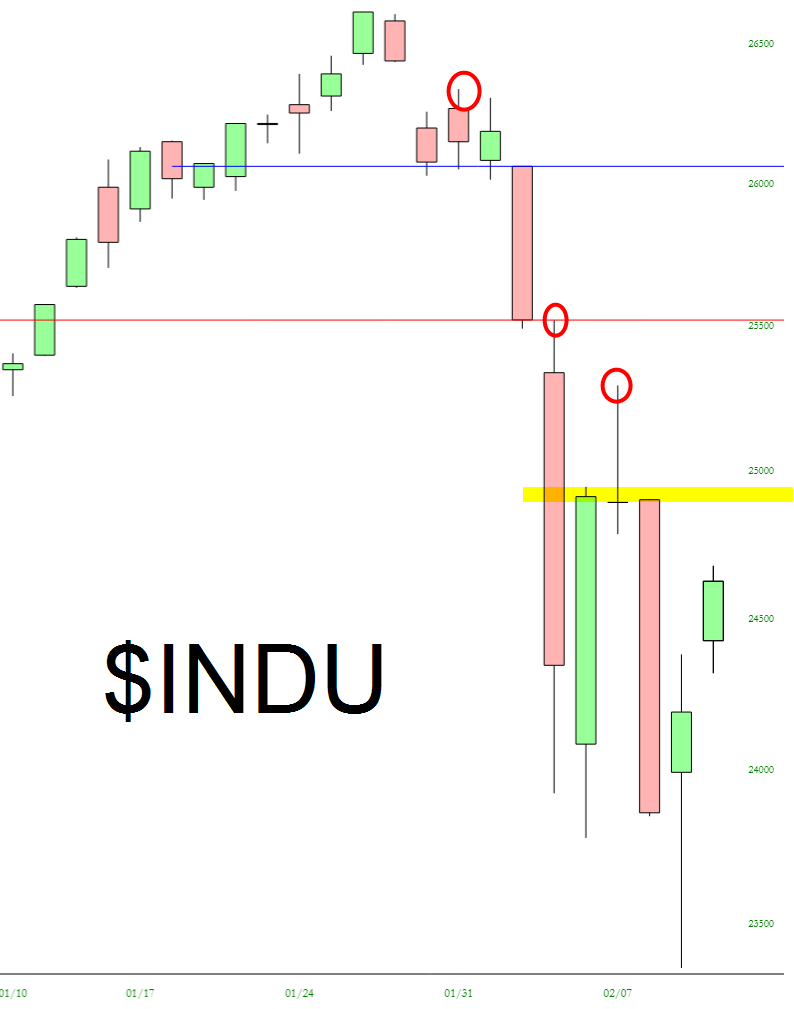

As mentioned in my 2018 Market Forecast, I think that volatility will remain elevated for much of 2018 (although to what extent will, no doubt, vary) in this evolving environment where Central Bankers are tightening monetary stimulus measures they deployed after the 2008/09 financial crisis.

As I posted in early February, near-term major support on the SPX lies somewhere in between 2525 and 2485. The upper edge of that zone was almost hit on Friday as it reached 2532, before snapping back to close the day higher.

The following daily comparison chart shows that 10-YR rates have held near their recent highs during the recent correction of the SPX. Whether rates continue to hold or push higher on any recovery in equities, and whether that may materially impact the extent of such a recovery, remains to be seen. As long as 10-YRT remains above, firstly, 2.67% and, ultimately, 2.5%, then equities will remain vulnerable to more wild swings and weakness. (more…)