There are plenty of things I like about a market like the one we are in right now, which is one of unchecked pandemonium.

There’s the profits, of course. It’s really gratifying to see my assets grow so swiftly.

The vindication of being right feels good, naturally. Having virtually every single prediction unfold as reality so swiftly is like a tall drink of water in the desert compared to the past nine years. I have 73 different short positions, and every last one of them is in the green (some of them massively so).

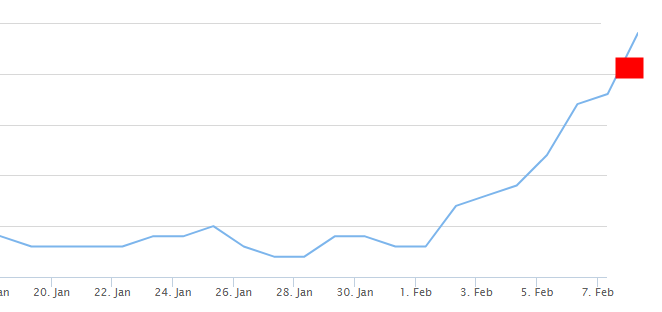

And since my trading life is tied directly to my little business, I get “icing on the cake” by having subscriptions to Slope PLUS go roaring higher.