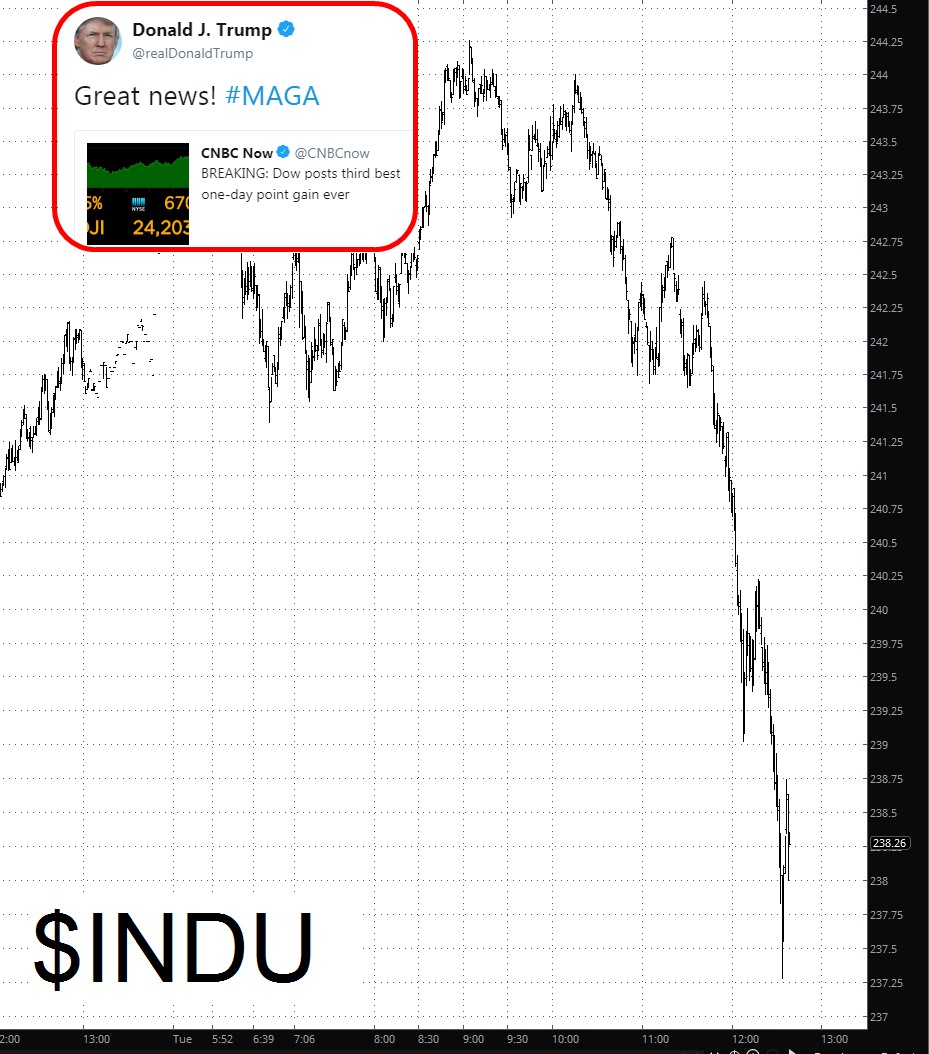

After the huge run-up on Monday, I was deathly concerned that we were in for another month-long grind higher, just like we experienced from February 9th to March 9th. Tuesday’s tumble helped lay that concern to rest.

Let’s just take another look at some big indexes and what they tell us. Let’s first examine the Dow Jones Composite.