Yesterday was a mixed day for technical signals but did deliver some useful levels, trendlines and inflection points. On both ES and SPX we now have clear declining channels from the high. These are shallow and look corrective so far. Here's how that looks on the ES 60min chart, with the notes that positive RSI divergence should be disregarded as the bounce between went over RSI 60, and that a break above this channel would look bullish and should deliver at least a test of the highs:

On the SPX 15min chart I have the same shallow declining channel. A low may be in now as SPX bounced at a decent support level and NDX made my right shoulder low target. I'll talk more about that below but here's the SPX 15min chart showing the declining channel:

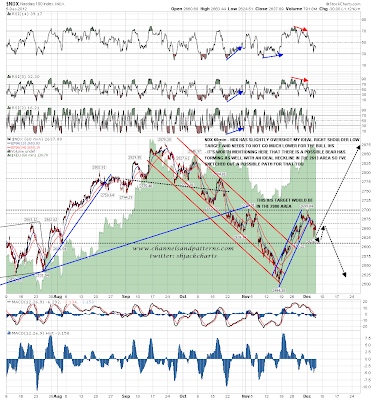

I'll skip the other SPX charts today as I want to look at a wider range of markets, but you can look at yesterday's post for the support and resistance levels on the daily chart as they haven't changed much since. On NDX yesterday the low was at 2624, a bit below my ideal right shoulder low and as well as the possible bullish IHS forming on NDX we now have a possible bearish H&S forming. The horizontal neckline would be in the 2613 area but we could have an upsloping neckline established yesterday. Any further downside will start to look potentially very bearish:

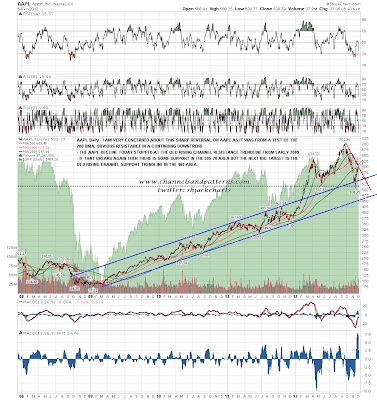

NDX was dragged down by the plunge on AAPL yesterday of course, and there too any further downside would look bearish, as AAPL found support yesterday at the upper trendline of the old rising channel from early 2009 to early 2012. Any lower invites a test of the main rising support trendline from 2009 in the 460 area. The strong reversal from the 200 DMA looks potentially very bearish for AAPL:

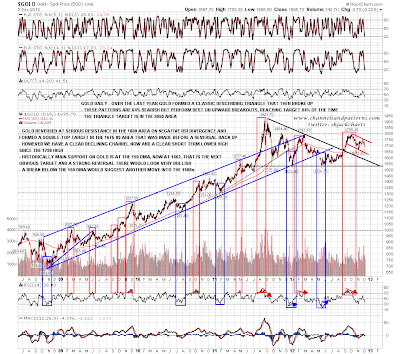

I've been giving gold a lot of thought over the last couple of days and while I'm still bullish there on the big picture, short term there is a clear declining channel from the 1798 high, and the obvious target is a test of the key support/resistance level at the 150 DMA. On the bull scenario we would see a marginal lower low and strong reversal at that test, and on the bear scenario a daily close significantly below the 150 DMA would strongly suggest a move back into the 1500s. If you look back over the last few years you can see that since early 2009 the 150 DMA has held ten times as support on a daily close basis, and that on the two closes below, gold then traded below it for at least several weeks afterwards:

On EURUSD there was a nice looking low on some positive divergence overnight and the retracement there may be over. There is important resistance and a possible IHS neckline in the 1.309 area above. No technical damage has been done to the EURUSD uptrend so far but obviously there is still strong resistance in the 1.314 area:

On CL there is a possible retracement low and significant inflection point established at yesterday's low. On the bull scenario CL has made a marginal lower low on positive RSI divergence and a break above declining resistance in the 88.25 area should signal a return to 90 and another attempt to break above 90 towards the bigger picture target in the 94.3 area. On the bear scenario, on a clear break below 87.5 triggers an H&S target back at main support in the 85 area. There's not much distance between short term support and resistance so I'd expect a break one way or the other today:

Vix isn't giving much away here. The 200 DMA is a possible reversal area and is holding so far, but the close on the middle bollinger band just says consolidation so far. Until we see a daily close below the middle bollinger band I still prefer the higher target at triangle resistance and the upper bollinger band in the 18.8 area:

Yesterday was a possible retracement low, and ideally for the bull scenario into Xmas, that was the low yesterday. A break up from the SPX and ES declining channels today should deliver a test of the recent highs and on a clear break over those, potentially a very decent bull move into Xmas and early 2013, fiscal cliff permitting. If however we see much more downside, particularly on NDX and AAPL, the bear scenario will increase in strength, though as I've said before, bears need clear breaks below strong support in the 1388 ES and 1390 SPX area before the bear case into the new year starts to look impressive.