Further to my

last weekly market update, this week's update will look at 6-month

Daily charts and 1-Week graphs of:

- + 6 Major Indices

- + VIX

- + 9 Major Sectors

- + Germany, France and the PIIGS Indices

- + Emerging Markets ETF and the BRIC Indices

- + Canada, Japan, and World Market Indices

- + Commodity and Agriculture ETFs, Gold, Oil, Copper, and Silver

- + 7 Major Currencies

On each of the

Daily charts are a 20 (blue) and 50 (red) sma. I'll be referring to

these as providing either short-term (20 sma) or medium-term (50 sma) support or

resistance relative to Friday's closing price, as well as identifying current

trend. I will not be referring to overbought or oversold conditions in this

particular post; rather, it will be a very simple analysis of where these

instruments are relative to these moving averages and current trend for the past

six months.

The graphs show percentage gained/lost for

each instrument during the past week.

6 Major

Indices:

Basically, the 20 sma is providing short-term support

for the Dow 30 and S&P 500, which are the leaders within this group. The 20

sma is serving as short-term resistance for the Nasdaq 100 and Russell 2000, and

these are lagging the first two indices…they will need to regain and hold

above the 20 sma to support any further rally in the Dow 30 and S&P 500. The

Dow Utilities needs to see the 20 cross and hold above the 50 sma before I'd

conclude that it has returned to a full-uptrend status. The Dow Transports is

the group laggard and also needs the 20 to cross above the 50 sma, plus a price

break and hold above the 5200 level before I'd consider it to have begun a

new uptrend.

the graph below, the Dow Transports was the biggest gainer, while the Nasdaq 100

and Russell 2000 had the smallest gains…ones to watch to see if strength

continues to build in these in support of any further rally in equities, in

general.

from a triple-bottom bounce (from mid-August), as shown on the

Daily chart. It's at lows not seen since 2007, and will need to

close and hold above 17.00 to signal that a reversal may be starting on the

SPX.

Sectors:

-

All of them, with the

exception of the Utilities sector, are in uptrend. -

Above their 20 sma

are XLY, XLI, XLB (just), XLP, XLV, and XLF…20 sma = near- term support. -

In between their 20

and 50 smas are XLK and XLE…20 sma = near-term resistance. -

In uptrend and above

the rising 20 but falling 50 smas is the XLU…it needs to see the 20 cross and

hold above the 50 sma before I'd conclude that it has returned to a full-uptrend

status.

the graph below, the Financials were the biggest gainer, followed by Healthcare,

and Consumer Staples. Energy and Technology were the smallest gainers and are

the ones to watch to see if they regain and hold above their 20 sma.

France and the PIIGS Indices:

in uptrend. However, France is the biggest laggard, relative to both smas.

France is the one to watch to see if it weakens further, or whether it can make

a higher high to continue in uptrend (it made a lower low, so a higher high is

necessary next). Greece is the only one that broke and closed above recent

highs.

the graph below, Greece was the largest gainer during the week and is the one to

watch for evidence of continued strength.

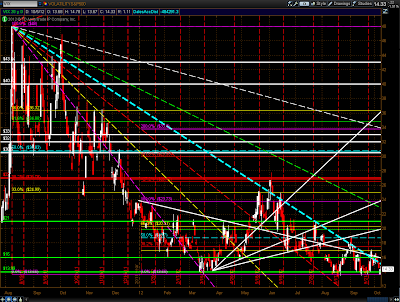

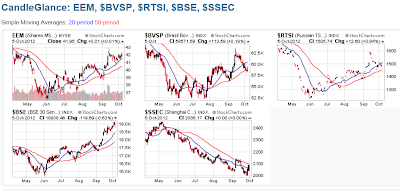

Markets ETF (EEM) and the BRIC Indices:

With the exception of

China, they are, generally, in uptrend. India is the leader of this group and

the one to watch for continued strength above its 20 sma. Brazil is lagging and

will need to regain and hold above both smas, and Russia will need to regain and

hold above the 20 sma. China will need to see the 20 cross and hold above the 50

sma and make a series of higher highs/lows before a reversal of the downtrend

can be considered to have begun…it has not yet stabilized and is still in

downtrend, with the 50 sma holding as medium-term resistance.

As can be seen from

the graph below, Russia was the biggest gainer, followed by EEM and India.

Brazil was the loser. China was closed this past week for a holiday.

Canada, Japan

and World Market Indices:

Canada and the World Market indices

are in uptrend, with the 20 sma providing near-term support. Japan is in a

slight uptrend, but price is currently below both smas and will need to regain

and hold above both before I'd consider it to be in a viable uptrend.

As depicted on the

graph below, the largest gainer was the World Market index, followed by Canada.

Japan was, basically, flat and will need to firm up, as mentioned above.

Commodity

(DBC) and Agriculture (DBC) ETFs, Gold, Oil, Copper, and

Silver:

- DBC is caught in between its 20 and 50 smas…the 50 sma is, essentially at

the neckline of a potential Head & Shoulders pattern. - The 20 has crossed below the 50 sma on DBA, and it is threatening to move

into a downtrend…a lower low will confirm that. - Gold is in uptrend, with the 20 sma serving as near-term support.

- The 20 has crossed below the 50 sma on Oil, and it is in a very tight-ranged

downtrend. - Copper is in uptrend, with the 20 sma serving as near-term support.

- Silver is in uptrend, with the 20 sma serving as near-term support.

As shown on the graph

below, Oil was the biggest loser, followed by Agriculture and Commodities…ones

to watch for signs of further weakness, which may pull equities down, as well.

Gold, Copper, and Silver will need to hold above their respective 20 sma, lest

they drop to their 50 sma medium-term support levels.

7 Major

Currencies:

- The U.S. $ is attempting to stabilize, but has closed just below its 20 sma

and is still in downtrend. - The Euro and Swiss Franc were the only two that closed above their 20 sma

and are still in uptrend. - The Canadian $ closed just below its 20 sma, but is still in uptrend. It

will need to regain and hold above the 20 sma to resume its uptrend; otherwise,

we may see it drop and hold below the 50 sma. If Canada's Index drops further,

along with Oil and Gold, the Canadian $ will likely follow suit. - The Aussie $ has had a couple of large swings below both smas and is now

threatening to make a lower low and send it into downtrend. The 20 has crossed

below the 50 sma, as well. - The British Pound is still in uptrend, but closed below its 20 sma. It will

need to regain and hold above the 20 sma to resume its uptrend; otherwise, we

may see it drop to its 50 sma. - The Japanese Yen has not made a higher high and will need to in order to

resume its uptrend.

As shown on the graph

below, the Aussie $ was the biggest loser this past week, followed by the Yen

and U.S. $. The Euro was the biggest gainer, followed by the Swiss Franc, and

Canadian $. What happens with the Greek and French indices next week may have a

bearing on the Euro in the short term.

As an addendum to the

above currencies, a resolution of China's downtrend will need to take place

soon, lest we see the AUD/CAD forex pair continue downward, as

mentioned in my earlier post on Friday. I would note that price closed

below the neckline of a large potential Head & Shoulders pattern on its

Weekly chart at 0.9969. The measured move target of 700 pips would,

ultimately, take price down to 0.93.

In

summary, China's Shanghai Index and AUD/CAD are important instruments

to watch next week, along with the Nasdaq 100, Russell 2000, Financials ETF

(XLF), France, Greece, India, Brazil, Canada, Japan, Commodities ETF (DBC),

Agriculture ETF (DBA), Gold, Oil, Copper, Silver, U.S. $, Euro, Aussie $, and

Canadian $.

Enjoy your weekend and good luck next week!

SB's DISCLAIMER: The

information contained within my posts may not be construed as financial or

trading advice. Please do your own due diligence before engaging in any trading

activity.