Before I begin, I want to say I am DELIGHTED at how many folks are updating their avatars (or creating new ones altogether) with the “Santa hat” theme. We’re a lively bunch, we Slopers. Just click here to go to your profile and update your avatar (or give yourself one). All the cool kids do it, and it’s free!

Now, on with the show. I’m confident most of you remember this from early 2009:

Yes, it’s the “green shoots” – – Obama was desperate to turn the spirit of the nation around, and this became a handy catchphrase. What it kicked off, of course, was plunging the country $21 trillion in debt to create the verisimilitude of prosperity. It worked for nine years. Now it’s out of time, and we are heading toward ruination. But at least we have an amoral retarded as our President to guide us.

I will state this plainly and simply: The Dow 30 has lost 2,500 points since the start of last month. There WILL be some desperate attempt to prop it up, and it’ll work for a day or two. But make no mistake. This is the start of a long, global bear market that’s going to destroy trillions and trillions of dollars.

So let’s take a look at the equity indexes, shall we?

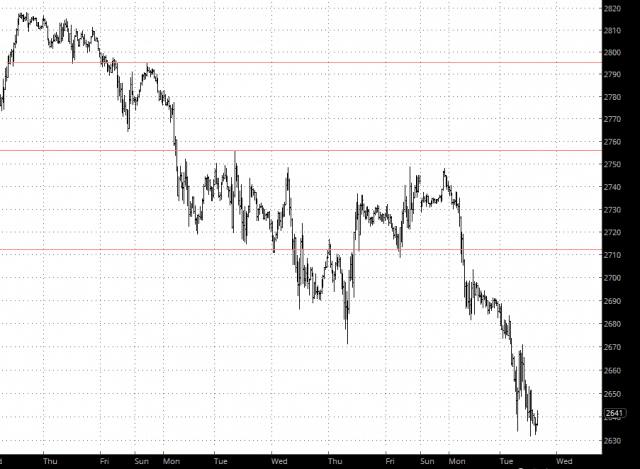

The past few days have been a fairly relentless grind down on the ES:

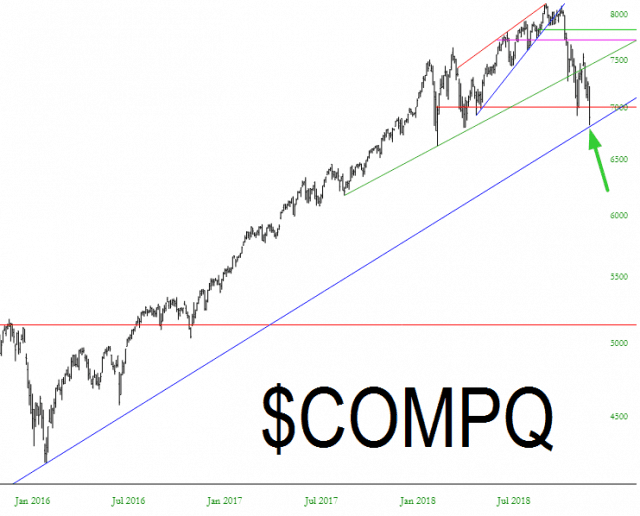

Today (that is, Tuesday) was a pretty important day, because we had a gap down in price on most indexes which really strengthens the bears’ hand. As I pointed out earlier in the day, however, we still haven’t broken the uptrend (established March 2009) on the NASDAQ Composite.

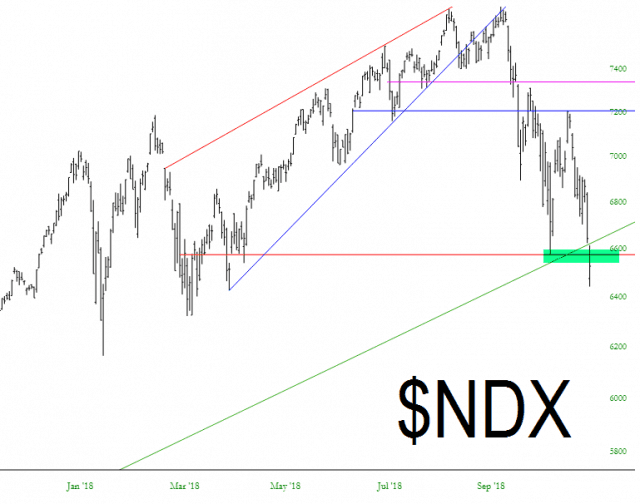

We have, however, broken the same uptrend on the NASDAQ 100. This is a fairly big deal: I want to emphasize, this trendline has been unbroken for nearly a decade until today.

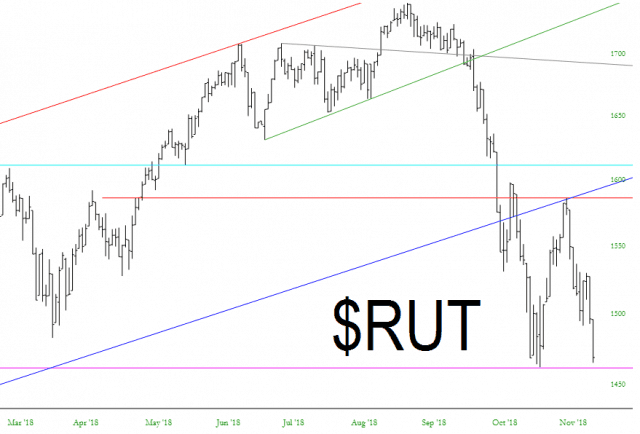

The small caps have found support at the magenta line I’ve drawn below. Even a modest “down” day would seal the fate of this, but for the moment, we have a double bottom.

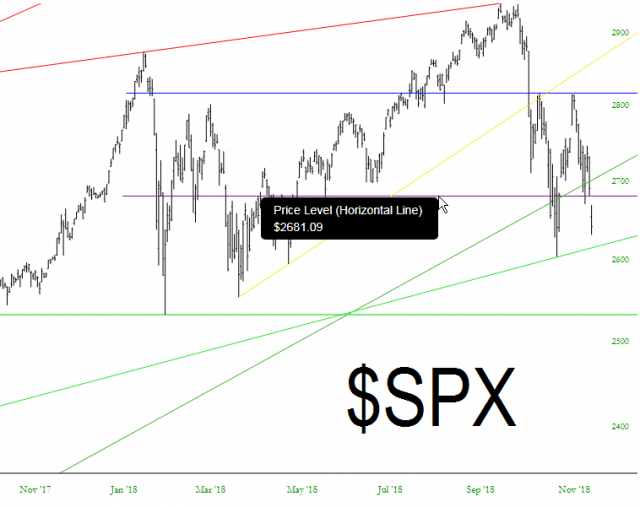

As for the S&P 500, it has also managed to stay above its long-term uptrend, although it’s getting close to a failure. I’m emphasizing the price gap today because I think it’s an important new highway marker for us all to take into account.

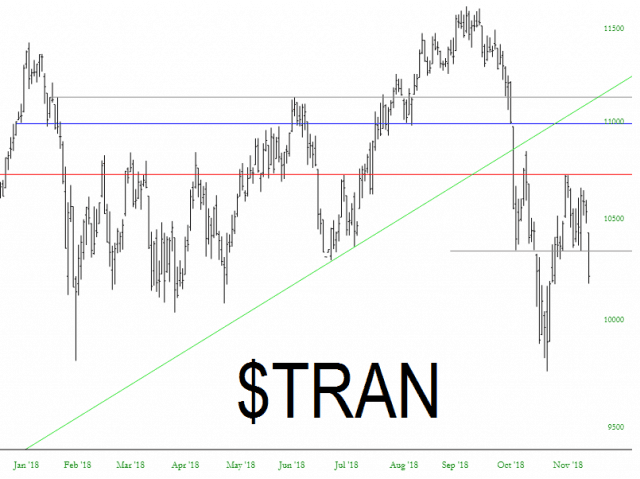

The short-term inverted head and shoulders pattern that I’ve been worried about, and so many others have been touting as the salvation of the bulls, is dead now. Just look at the Transports for one example of how this prospective pattern has been rendered moot.

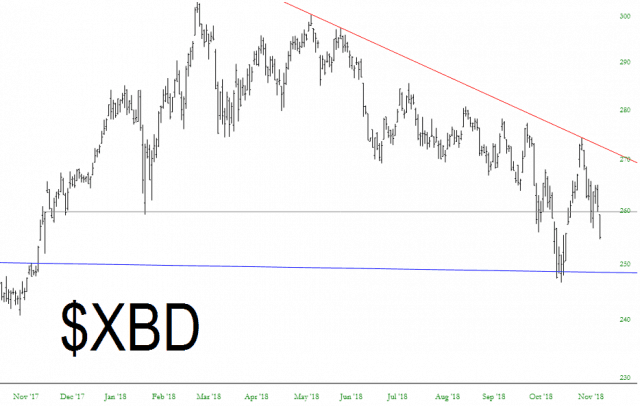

The financials, an absolutely key element of this nascent bear market, continues to finish a monumental top. We need to take out the lows of late October to complete it.

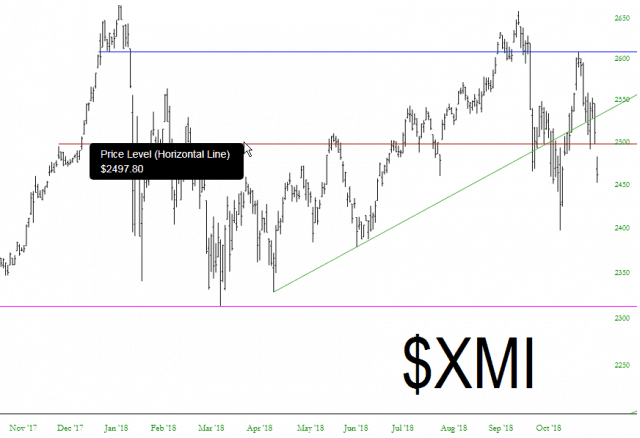

Finally, the Major Market Index has broken any semblance of a bullish formation.

I entered Tuesday with 100 shorts but exited with 80.