I first remember seeing Ricky Jay on Magnolia, one of my favorite movies ever. He passed away a few days ago, and I wanted to share this video. Ricky was the absolute king of the stage and banter. Rest in Peace, Ricky Jay.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

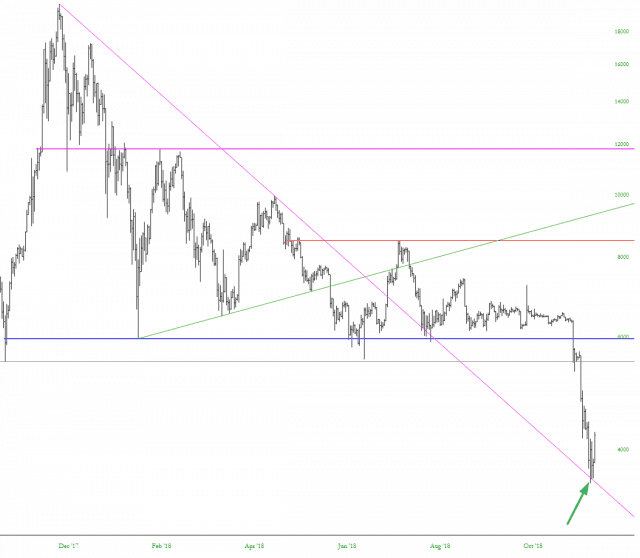

One Nightmare to Go

Crypto Trendline Bounce

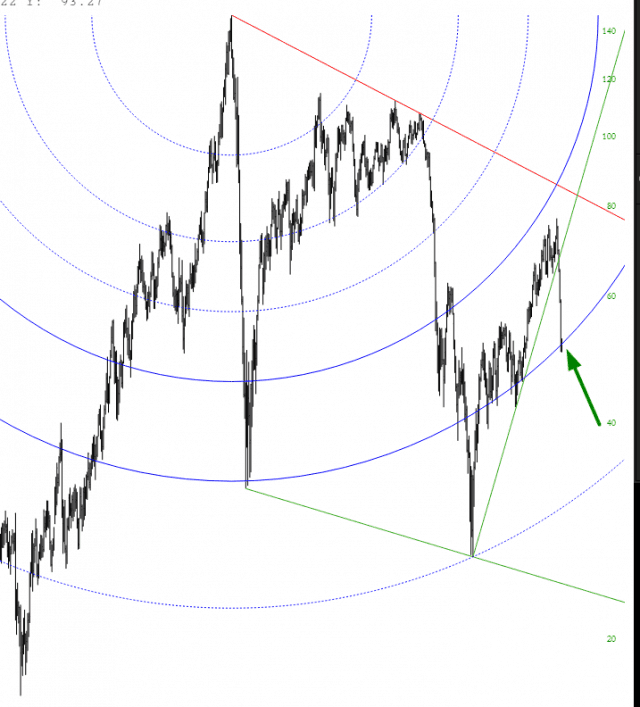

Oil Strength

I did a “crude oil is gonna go up” post recently, but I wanted to pile on with this Fibonacci arc graph of the continuous contract:

So Like I Said

Read the post from TWO DAYS AGO, which declared:

The bullish base on the ES is just as clean. There are easily another 40 points of pain in store for the bears. Let’s face it, the market has been beaten to smithereens, and Monday’s powerful bounce could be just the beginning of something larger. To be clear, I think we’re in a bear market, but countertrend rallies are just part of life when it comes to bear markets. They’re vicious, violent, and quick. The measured move on the ES is something a little north of 2710.

And I showed this: