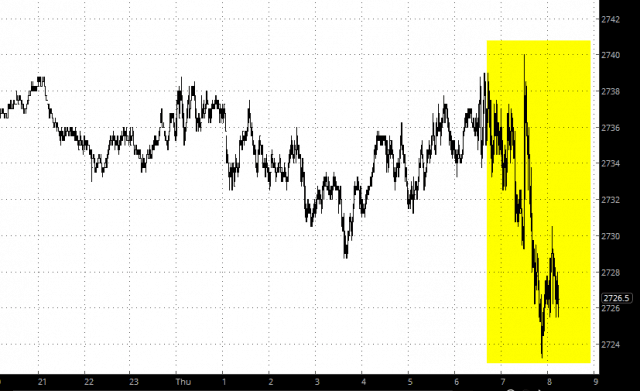

At the open Thursday morning there was a key common thread on SPX, NDX and RUT, in that all three were either close (SPX & NDX), or at (RUT) their key resistance trendlines from the all time highs. As I’ve been writing the falling channel resistance on SPX and falling wedge resistance on NDX have both broken, with RUT having already broken up earlier today.

What this means is that this move is entering a new phase, either setting retests of the all time highs or signalling retracement and consolidation before the next move down. The more obvious move is retracement and consolidation but we could see the high retests, and I’d note that the seasonality favors the bulls into late December, and that while all the hourly RSI 14 buy signals made target yesterday, the daily RSI 14 buy signals on SPX, NDX and RUT are still nowhere near target. (more…)