This was just posted. Oh. My. God. Put it on full screen and watch the whole thing.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

General Gap-Fill

You may have read the news that General Motors is firing 14,000 workers (must be another benefit from all that manufacturing in America success we’ve been seeing). Although this is bad news for the 14,000 getting fired (to say nothing of their families), the shareholders love, love, love it. As a chartist, I wanted to point out to you that it makes for a nearly perfect gap-fill.

Forty More Pain Points?

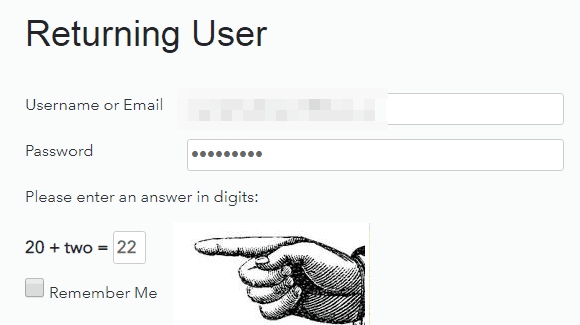

I wanted to start off by first saying we have really clamped down on security on the site. As Slope has become increasingly popular, it also has become of greater interest to automatic “bots” that try to break into sites (just FYI, no financial or payment information is stored at Slope, so frankly there’s no particularly useful data to steal anyway!) In any case, we’ve made a number of security improvements, including the fact that you have to solve a simple math problem in order to log in now:

Destination Zero

First off, please press Ctrl-F5 on your keyboard. We’ve been doing a lot of tweaking on the site, and I want to make sure you get the latest, freshest version. Please do it now. I’ll wait.

OK, thanks. I hope you’re seeing the speed improvement on the site. It’s certainly miles away from what it was a week ago!

I’m sure you’ve heard about the continuing crumbling of the crypto chasm chronicled. As a chartist (and not a crypto trader), I can only point out that pink line as being the last sorta-kinda support for the bluest of the blue chips, Bitcoin, which is the kind of the cryptos with about 2,000 lesser coins under it. It has lost “only” 81% of its value, as opposed to 90%, 95%, or 99.9%.

Oil Ready to Rally

Oil fell pretty much nonstop from October 3rd until November 23rd. At that time, I pointed out the magenta horizontal (shown below) as well as the blue descending trendline, each of which I felt would act as support. So far they seem to have done so, and as rapidly as oil fell, the “bounce” could be just as swift (although certainly not with enough power to recover all those losses).