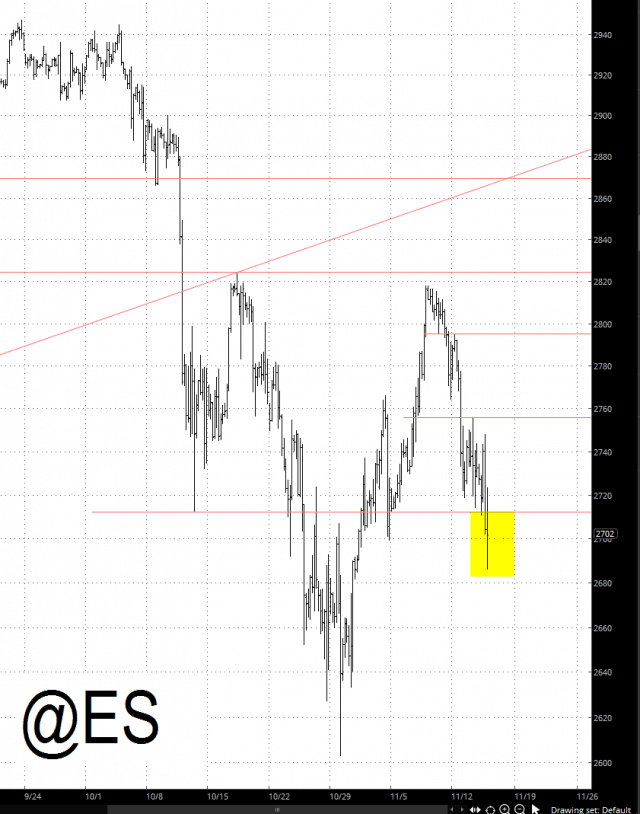

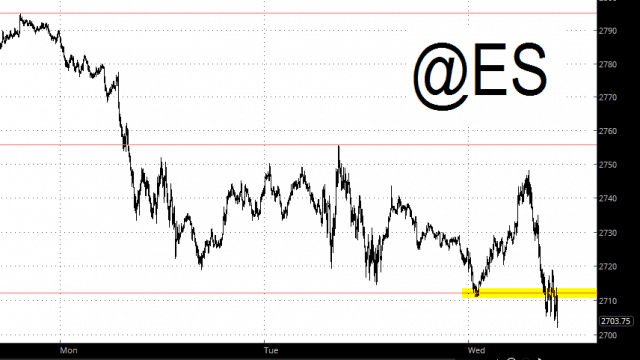

The support level on the ES I was so worried about in Tuesday night’s video turned out, in the end, to fail, thus negating the prospect of an inverted head and shoulders pattern to save the bulls:

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

An Occasional Pisser

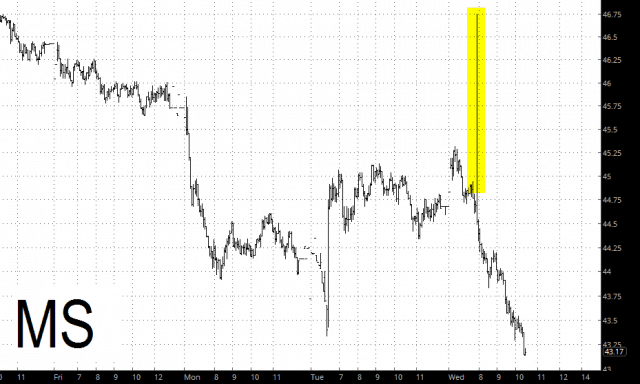

Allow me to grumble a moment. In the course of trading today, my trading computer unexpectedly “dinged”, and I saw I was just stopped out of Morgan Stanley (MS). This didn’t make sense to me. I glanced at my spreadsheet, and my stop price was miles away from the price. However, there was a momentary and inexplicable spike in trading. I expect this kind of nonsense with thinly-traded issues, but not the likes of Morgan Stanley. I got back in, but I was pissed. I took a loss on the former position, and I paid a worse price for the new one. I have no point here. It just bugs the hell out of me.

It’s Full of Stars

I am an enormous Stanley Kubrick fan, and I spent much of the trading day watching videos about the genius and his work. Here’s one I liked in particular that I wanted to share with everyone here:

Crypto Industry Collapse Continues

I had been joking for weeks now that Bitcoin seemed to be stuck at precisely $6400. Its volatility has basically gone to zero. Whereas a year ago the entire world was OBSESSED with crypto (and all the scamsters and con artists crawled out………..) now it’s quite evident this technology was simply a solution in search of a problem (……..a problem which apparently doesn’t exist) and the entire “industry”, if one dares use such a term, is collapsing. $BTC has broken support.

Support Failure

The crucial support level I highlighted in last night’s video has been breached.