Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

From Our Contrary Perch, an Update on Bonds

[edit] Today I took profit (principal & interest) on 7-10 year Treasury fund IEF in order to concentrate on the shorter end of the curve for ‘cash equivalent’ income.

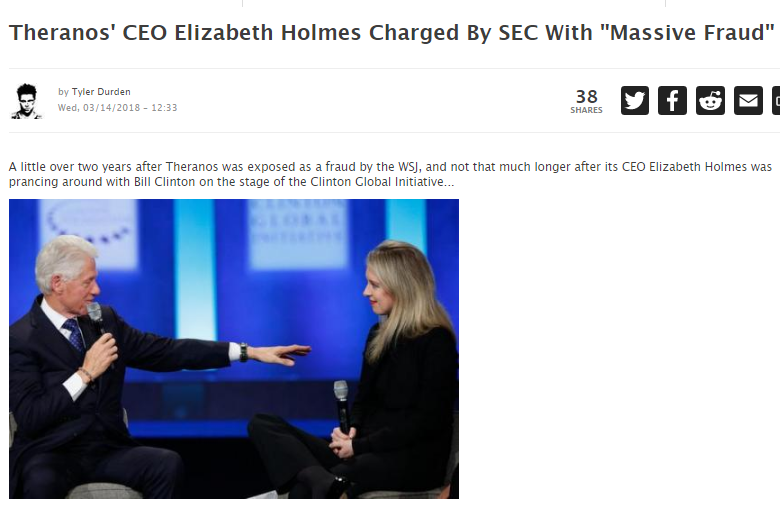

[edit 2] I know TK gets a kick out of this picture, so here it is again! (Editor’s note: get this man a lozenge!!)

With all due respect to Bill, Ray and Paul the play has been for a contrary move in bonds with our 3 leading experts emblematic of the media’s habit of pointing the investing herds the wrong way at the wrong time. Making myself clear again, I don’t dispute the potential – even likelihood – that a bond bear market began in 2016. But I do dispute every single call out there that it has been technically proven. (more…)

Testing Key Support

Yesterday’s promising start to the downtrend has continued today and brought ES & SPX down to test important trend support at the weekly pivot on ES at 2749 and the 50 hour MA on SPX now at 2751. SPX is trading about 4 handles below ES today. A decent confirmation that support is breaking would be a fill of the open breakaway gap on SPX from 2738.97. It is of course possible that this support level won’t break, so bears really need to push down through this. Intraday Video from theartofchart.net – Update on ES, NQ and TF:

Slopers Are Not Surprised

Overjoyed

My best cash profit from my shorts is from Overstock, which I’ve written about before. I’ve never respected this company, and their latest gambit of going into cryptocurrency compelled me to just short them out of a combination of spite and chart observation. So far, so good…..