Further to my last weekly market update, this week's update will look

at:

- + 6 Major Indices

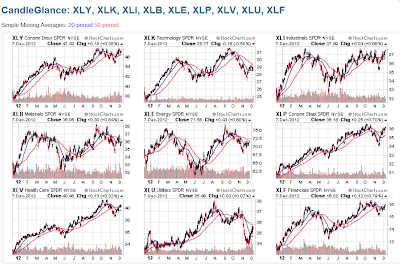

- + 9 Major Sectors

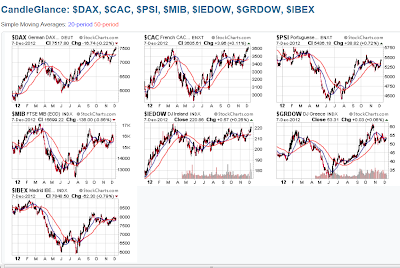

- + Germany, France, and the PIIGS Indices

- + Emerging Markets ETF (EEM), the BRIC Indices, and the BRIC ETF (BKF)

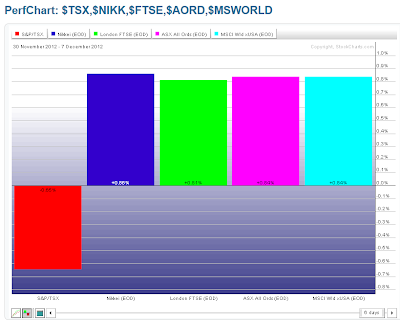

- + Canada, Japan, Britain, Australia, and World Market Indices

- + Commodity and Agriculture ETFs (DBC and DBA), Gold, Oil, Copper, and Silver

- + 7 Major Currencies

- + Major Trendline Breaks on 7 Major Indices

- + 30-Year Bonds

You won't see any

commentary for the first 7 groups, as I simply wanted to show,

at a glance, two things:

- where current price is relative to support/resistance levels, and

- which groups money was flowing into and out of this past week

in

order to assess whether there was a common theme(s) going on

here. In this regard, I've provided 1-Year Daily thumbnail

charts and 1-Week percentage gained/lost graphs for

each group.

You can see from the Daily charts where current price is

relative to resistance/support levels. Most of them are at either

downtrend, horizontal, or moving average resistance…although Gold, Oil,

Copper, and Silver are hovering above support levels, but threatening to

continue downward. That is, in a nutshell, the common theme, at the

moment.

Also, you can see from the percentage

gained/lost graphs that, generally, there was more buying than selling

this past week, except in Technology, Commodities, the Euro, and the Swiss

Franc. This is also the common theme, at the

moment.

To summarize, the

exceptions (Technology, Commodities, the Euro, and the Swiss Franc) are the ones

to watch going forward to see if this weakness persists, and to what degree.

Furthermore, inasmuch as most Indices/Sectors/Currencies are

trading up against some form of resistance, we should be looking for any

major news announcement(s) (such as the upcoming FOMC

meeting rate announcement and press conference on December 12th) that

may either spur continued buying, or dampen and, potentially, reverse this

trend. The dreaded "Fiscal Cliff" issue has been the 'topic du

jour,' as the U.S. markets continue to make wild intraday swings when one of the

political leaders holds a press conference to report that, basically, nothing

has been resolved.

6 Major Indices

9 Major Sectors

Germany, France, and the PIIGS Indices

Emerging Markets ETF (EEM), BRIC Indices, and BRIC ETF (BKF)

Canada, Japan, Britain, Australia, and World Market Indices

Commodity and Agriculture ETFs (DBC and DBA), Gold, Oil, Copper, and

Silver

7 Major Currencies

Major Trendline Breaks on 7 Major Indices

Below are Weekly

charts for the Dow 30, S&P 500, Nasdaq 100, Russell 2000, S&P

100, Dow Utilities, and Dow Transports Indices. Drawn on each is a major uptrend

line from the October 2011 lows.

As I've mentioned in the past,

each index has broken below this major trendline. The only one

that has broken back and closed above is the S&P 500 (for the third week in

a row). So far, the Russell 2000 and S&P 100 have yet to break and close

above, while the Dow 30 played catch-up this week, as shown on the first graph

above. The Nasdaq 100 was notably weak, with the pullback in AAPL weighing on

this index, as well as on the S&P 500 and 100

Indices.

So, AAPL's movement next week

will, no doubt, have a significant impact on the Nasdaq 100, S&P 100, and

S&P 500 Indices, and will be a stock to watch, along with the Dow

30 (to see if it continues to outperform the other indices in the

week(s) ahead). I last wrote about AAPL here, and my comments are worth noting, as they're still

applicable…e.g., see the section on the imminent "Death Cross" forming

on both the AAPL and the NDX Daily charts.

30-Year Bonds

Once again, price on the

Weekly chart below of 30-Year Bonds closed on Friday just above

near-term support, after retesting a level just below. Failure to hold this

support level may induce serious bond-selling, which could begin on a larger

scale if price then failed to hold at the next support level (around the lower

Bollinger Band/50 sma). Any substantial weakening of Bonds may produce a

large-scale rally in equities…one to watch over the next

days/weeks.

In conclusion,

rather than repeat myself, I would just refer you to my comments made

this past week in my posts of December 7th, December 2nd, and November 30th, as they are still appropriate for the week(s)

going forward (e.g., look for the wild intraday swings to

continue).

Furthermore, we may see further

buying on the beaten-down high-beta stocks, as has continued

this past week, in the Social Media stocks and RIMM, (as shown

on the 1-Week percentage gained/lost graph below), as fund

managers attempt to top up their yearly portfolio gains before the end of the

year. I'll be looking for any parabolic rise and climax on high volumes on

stocks such as these as a precursor to a potential major market trend reversal.

If this type of stock continues to explode higher in the near-term versus value

stocks, I'll also be warned of potential Q4 earnings weakness (markets favouring

beta-movers versus actual value).

Enjoy your weekend

and good luck next week!