Further to my last weekly market update, this week's update will look

at:

- + 6 Major Indices

- + 9 Major Sectors

- + Trendlines on 7 Major Indices

- + China's Shanghai Index and the European Top 100 Index

- + 30-Year bonds

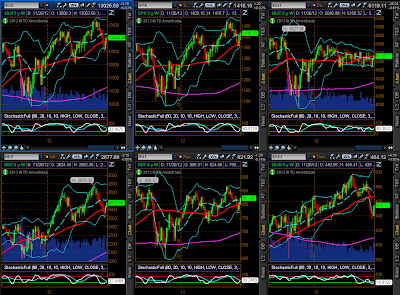

6 Major Indices

The three chartgrids below show Monthly,

Weekly, and Daily timeframes of the six Major Indices, along with the

Stochastics indicator. Inasmuch as today (Friday) closed out the month of

November, I thought I'd show where price is relative to these

timeframes.

Price is pushing up against resistance (either near-term or

major, longer-term) in overbought territory on negative Stochastics divergence

on the Monthly timeframe. The Stochastics indicator is bouncing up off oversold

territory on the Weekly timeframe, and it is in overbought territory on the

Daily timeframe.

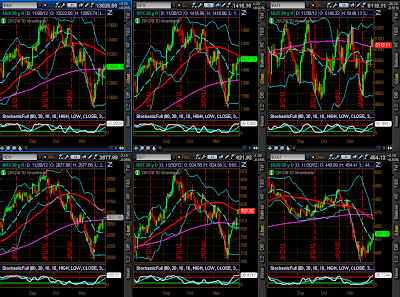

They all closed higher

on the week, as shown on the 1-Week percentage gained/lost

graph below. The Utilities Index made the biggest gains, followed by

the Russell 2000 Index. The Dow 30 Index was, basically, flat on the

week.

9 Major Sectors

The three chartgrids below show Monthly,

Weekly, and Daily timeframes of the nine Major Sectors, along with the

Stochastics indicator.

As with the Major Indices above, price is also

pushing up against resistance (either near-term or major, longer-term) in

overbought territory on negative Stochastics divergence on the Monthly

timeframe. The Stochastics indicator is bouncing up off oversold territory on

the Weekly timeframe, and it is in overbought territory on the Daily

timeframe.

Seven of the nine

Major Sectors closed higher on the week, as shown on the 1-Week

percentage gained/lost graph below. The Utilities Sector made the

biggest gains, while losses were made in the Energy and Financials

Sectors…slightly favouring the "Defensive" sectors.

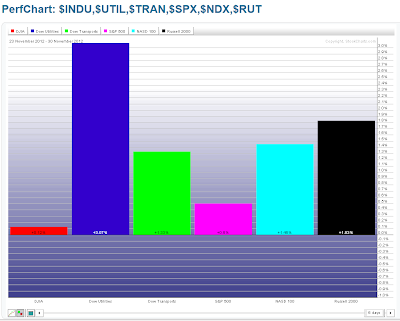

Trendlines on 7 Major Indices

Below are Weekly

charts of 7 of the Major Indices, with a major trendline shown on each

(discussed in last Friday's weekly market update), which begins from the October

lows of 2011.

This week, the SPX tested both sides of its break back

above its trendline (which it made last week) and closed above it for the second

week in a row. It's important for the SPX to hold above 1400 and this major

trendline in order to continue to support a bull case. The RUT and the OEX

closed on the underside of their respective trendlines today and will need to

cross and hold above to support any further rally on the SPX. The NDX and the

three Dow Indices have yet to backtest their major trendlines.

What may

interfere with a continued rally next week is the overbought reading on the

Stochastics indicator on the Daily timeframes on the Major Indices and Major

Sectors, as I mentioned above. We may see a bit of a pullback to

relieve such a situation, before they, potentially, continue what is,

traditionally, a Christmas rally.

However, market

participants may be expecting further monetary stimulus measures to be announced

at the next FOMC meeting on December 12th, and a potential resolution of the

"Fiscal Cliff" issue before Congress begins its vacation on December 14th, so we

may not see a pullback until we get closer to Christmas, and possibly the end of

the year.

Intraday volatility has been varying wildly

recently from large, swift swings to narrow, compressed ranges, with

price moving on news events…making for schizophrenic and unpredictable

moves…not surprising with the Major Indices and Sectors pushing up against

major resistance on Monthly timeframes in overbought territory, as well as the

unresolved "Fiscal Cliff" issue (and looming Debt Ceiling issue), seasonal

factors (Christmas/Boxing Day market closures), upcoming unemployment data on

December 7th, Options Expiration (Quadruple Witching) on December 21st, and end

of Q4 on December 31st. I expect this type of volatility to continue

until the end of the year, and possibly into next year…particularly, until the

Monthly overbought Stochastics cycle has reversed and been resolved on the Major

Indices and Sectors.

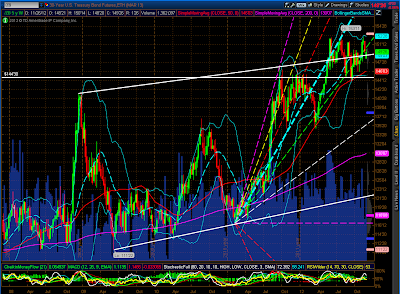

We may also see a

continuation of unusual buying of beaten-down, high-beta stocks, as has

been occurring recently in the Social Media stocks and RIMM, as I mentioned in

my post of November 24th, as fund managers attempt to top up

their yearly portfolio gains before the end of the year. I'll be looking for any

parabolic rise and climax on high volumes on stocks such as these as a precursor

to a potential major market trend reversal. If this type of stock continues to

explode higher in the near-term versus value stocks, I'll also be warned of

potential Q4 earnings weakness (markets favouring beta-movers versus actual

value). Here's an updated Daily shot of how they ended this

week…FB is leading the rally in this group.

China's Shanghai Index and the European Top 100 Index

The

Shanghai Index continues to make new lows, while the

European Top 100 Index remains range-bound at major resistance

levels, as shown on the Daily charts below. These are two other

indices I'm following, as further weakness in China, and any further weakening

economic data coming out of Europe could depress any further meaningful advance

on the U.S. markets (unemployment continues to rise unabated in Europe, which

will, no doubt, be exacerbated by further austerity measures that may be imposed

on EU countries). Any further stimulus measures that may be forthcoming from the

ECB would be announced at their upcoming rate announcement and press conference

on December 6th.

30-Year Bonds

Price on the Weekly chart below of

30-Year Bonds closed on Friday just above near-term support, after retesting a

level just below. Failure to hold this support level may induce serious

bond-selling, which could begin on a larger scale if price then failed to hold

at the next support level (around the lower Bollinger Band/50 sma). Any

substantial weakening of Bonds may produce a large-scale rally in equities…one

to watch over the next days/weeks.

Enjoy your weekend

and good luck next week!