I was writing a few weeks ago that it was all too easy to see a situation where the fiscal cliff was allowed to happen. The republicans could avoid agreeing to politically difficult tax rises, the democrats could blame the republicans for being too inflexible to compromise. An agreement early in the New Year could mitigate the effects with spending and tax cuts that eliminated most of the cliff and those tax cuts would henceforth be known as the Obama tax cuts.

Over the last couple of weeks it seemed that nonetheless an agreement was likely, but this wasn't the case, as it seems that Boehner couldn't muster the votes yesterday for an agreement that included any tax increases at all. It seems equally unlikely that the democrats and Obama would allow any agreement that doesn't include tax increases, so it seems likely now that the fiscal cliff will be allowed to happen, and that negotiations in early 2013 will be about what will replace the fiscal cliff agreement.

What does this mean for markets? A lot of uncertainty over the next couple of months, and it seems doubtful that the bullish looking setups here will survive that, but we'll see. (Editor's Note: I sure hope not).

There was a most impressive drop on ES overnight, finding support in the 1417.5 area, but with an intra-hour pinocchio down as far as 1391.25, a drop peak to trough of fifty points in four hours. As it happens this established a nice looking rising channel on ES from the November low, though I'm doubtful about that holding. The important support levels for today at 1417.5 and 1405.45, and significant resistance is at 1424 and 1432.5:

On SPX the close yesterday was at the upper bollinger band. Given the scale of the move overnight a test of main support in the 1414-19 area today or Monday seems likely. That is at the cluster of the middle bollinger band (1419) and the 100 and 50 DMAs, and main uptrend support is there. On a break below there the lower BB is at 1394 and the 200 DMA is at 1389. If SPX should get that far that would be a second conviction break of the rising wedge support trendline. That would obviously look significantly bearish and set up a possible double-top with a target in the 1215 area on a conviction break below the November low at 1343:

On NDX I'm looking at 2660 area support today. On a break much below that I would be writing off the bullish rectangle targeting the 2770 area:

On EURUSD there is now a possible double-top formed with a target in the 1.307 area on a clear break below 1.318. There is some decent support in the 1.31 area:

CL is retracing as expected from 90.2 area resistance having formed a nice little double-top there on negative RSI divergence yesterday. The obvious target is double trendline support in the 88.1 area. On a break below that there is very strong support in the 84.5 to 85.5 area:

Vix has been hinting at trouble on equities for the last two closes, with both of those at the daily upper bollinger band. I have possible triangle resistance in the 18.8 area somewhat higher:

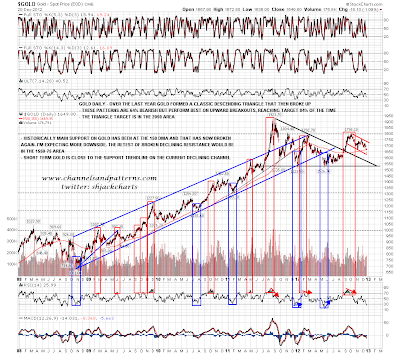

Gold broke well below the 150 DMA yesterday, and this is a signal for further weakness. Short term gold is close to declining channel support in the 1630 area:

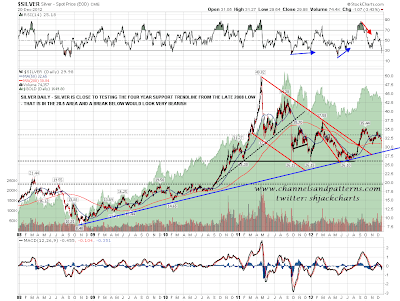

It is the silver chart that really draws the eye here however. The summer low was a perfect touch of a support trendline from the late 2008 low. That is now in the 28.5 area and a break below would look very bearish indeed:

What is the big picture view here? When people were talking about the possibility of a major top having been put in at the September post QE Infinity announcement spike, my response was that it would be an odd looking top, and a key reason for that was that most major highs and lows on SPX are signaled with either an H&S or a double-top. My preferred kind of double-top has a slightly higher high on negative RSI divergence, but on many double-tops the second high is lower, with the key requirement for a decent double-top being that the two highs be within 3% of each other, though this can sometimes stretch to 5&, and I prefer to see a difference ideally under 2%. The difference between the September and December highs at the moment is slightly over 1.8%.

With rising wedges the first break below the support trendline is generally just a signal that the topping process has begun. If a topping pattern then forms before a second break below that support trendline, that is generally a strongly bearish signal. For that reason if 1414-19 area support fails to hold on SPX that will be a very bearish looking development. We'll see if that area can hold. If it doesn't we could well be looking at the start of a very major decline here, and it's worth noting that the 1215 possible double-top target is just under the 61.8 fib retracement level for the advance from the October 2011 low.

In other news today is the 21st December 2012, and according to some, this is the scheduled date for the end of the world according to the ancient Mayan calendar. If so I'll be hoping that this will be late in the day on EST, so I will have time to see The Hobbit with my kids later on today. If perchance the world doesn't end today, and for those who are signing off until after the holidays, have a great Xmas or holiday! I expect to be doing a post on Monday morning.