The new Slope of Hope has been humming along error-free for a solid week now. It’s a pleasure to see this:

You’ve probably been noticing little improvements here and there. For instance, today we added social media buttons to posts. Just by happenstance I some some chatter about folks missing the Tweet button in comments. My response is twofold: (a) OK, we’ll bring it back; I was just trying to save a little space (b) for goodness sake, please don’t leave it to chance for me to see suggestions like this. Email me. It isn’t like I haven’t asked a dozen times. Please!

Anyway, I’m not feeling there’s a particularly lot of new things to say, so we’ll just take a look at some intraday charts to wrap the day.

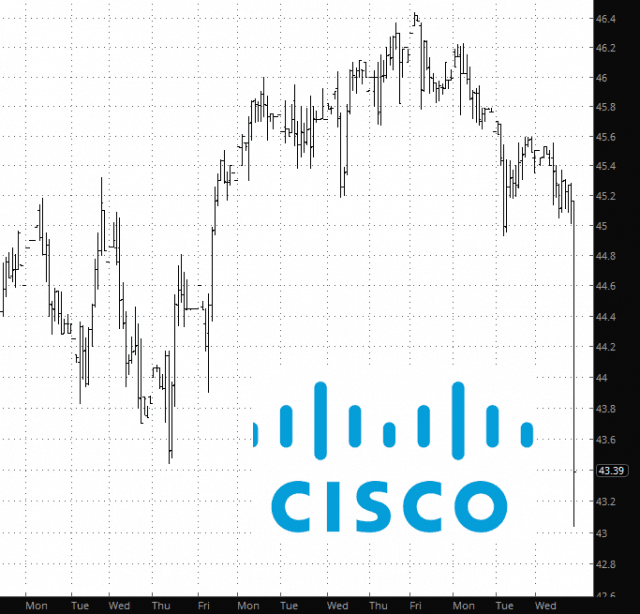

One of the few big companies left to report earnings was Cisco. It doesn’t look like the market is taking the news especially well. There was a time in history (around 2000) such a drop would guarantee a huge down day tomorrow. Errr, not so much anymore. Cisco isn’t the largest company on the planet like it used to be. Indeed, no one gives a crap anymore. Not one crap.

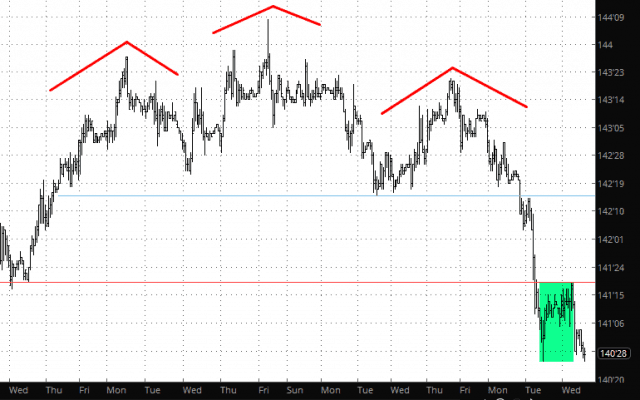

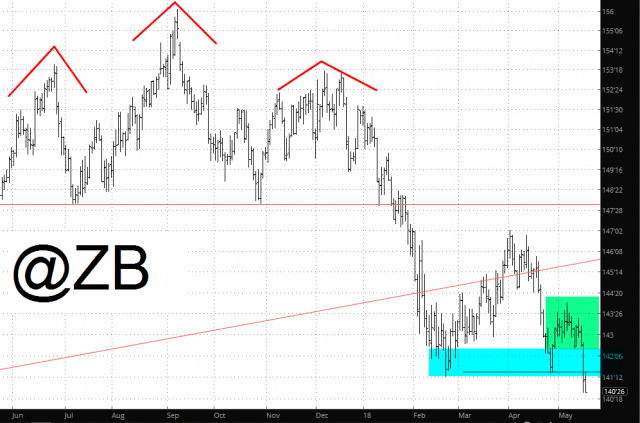

My “huzzah!” moment today was how the fight-back on bonds got smushed. You can see how bonds tried to rally (green tint), but it flopped over and ended at the lows of the day. Yay!

This pattern fits within the broader context of the daily chart below. Indeed, the fractal is pretty amazing.

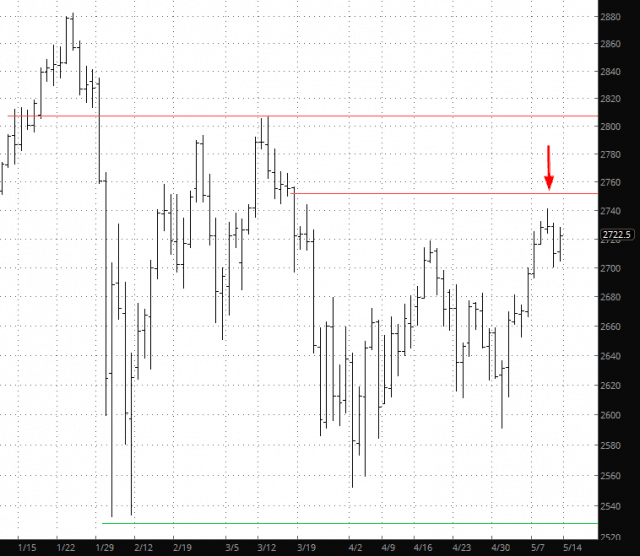

As for equities in general – – meh. It seems like we can’t get more than one stinking down day anymore. We had a little dip yesterday, but, lo and behold, we had to flip it right around Wednesday. Quite annoying. We need to hold below 2750 on the ES to keep me and the other two bears on the planet from going suicidal.

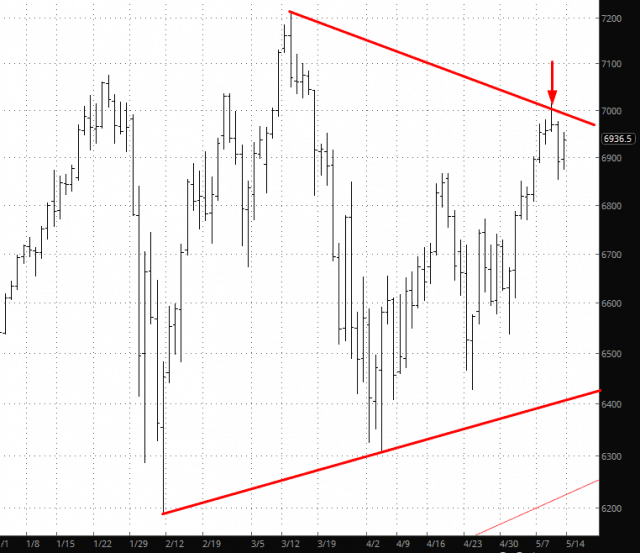

Likewise, the NASDAQ needs to stay below the peak it made on Monday.

Generally speaking, it’s far more important for me to see bonds continue to weaken than it is for the likes of the NASDAQ to behave itself, but I gotta tell ya, it sure would help if the red numbers were a little more consistent among all the asset classes.