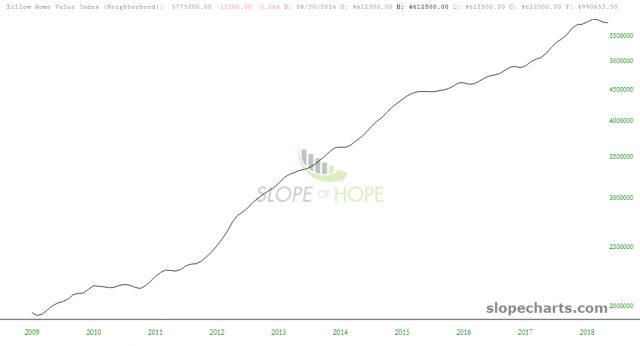

Here in my hometown of Palo Alto, the fervor about real estate is definitely gone. A couple of years ago, it was absolutely manic (see chart below, which you can see yourself in SlopeCharts with the symbol $PALO). Chinese buyers were paying all cash. Facebook and Google employees were trying to outbid each other on single family homes. And lucky ducks like me who bought in 1991 had to smirk at how the values kept lurching ever-higher. Not anymore.

The poor sumbitches who bought in the past few years could have a real stink on their hands in the following fashion:

- They’ve already laid out a huge down payment of many hundreds of thousands of dollars;

- They’re on the hook for a giant monthly mortgage bill;

- Interest rates are lurching higher, so the aforementioned monthly bill is going to go up;

- They’ve also got a tax bill for about 1.1% of the property value every single year;

- As well as the insurance based on the home’s value;

- Plus property values are already getting soft, which means their have a leveraged investment which is declining;

- Their 401-k and ESOP plans have already taken big hits, as companies such as AAPL and GOOGL have lost meaningful portions of their value;

- Finally, if the fortunes of high tech companies continues to sour, their very salaries and bonuses could be at risk

It seems like one hell of an uncomfortable position.