I last wrote about the FAANGs and FNGU and what I was monitoring going forward in my post of July 30.

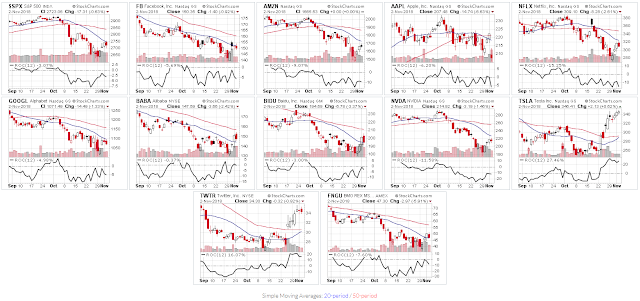

Since then, we’ve seen a great decline in the underlying stocks, as can be seen on the following two daily charts (a 1-year and a 2-month).

Of particular note, is that:

- many of them, are attempting to stabilize around their 20 MA (blue)

- the rate-of-change (ROC) indicator on all of these, including the SPX, except TSLA and TWTR are below the zero level

- the 20 MA is below the 50 MA, including AAPL which just crossed below

- the 20 MA is poised to cross back above the 50 MA on TSLA and TWTR

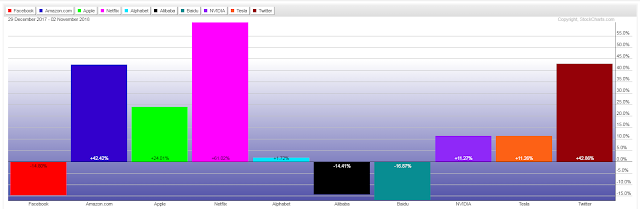

The following year-to-date percentages gained/lost graph of the FNGU stocks show that NFLX, TWTR and AMZN are still up the most, while BIDU, FB and BABA have lost the most in this timeframe.

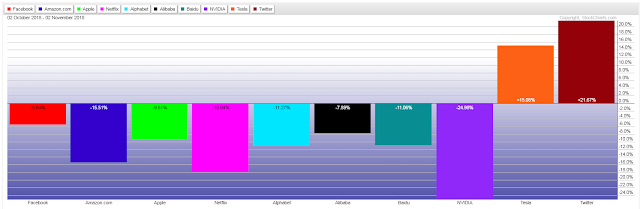

The following one month percentages gained/lost graph of the FNGU stocks show that TSLA and TWTR have gained the most, while NVDA lost the most, and the others suffered considerable losses in this timeframe.

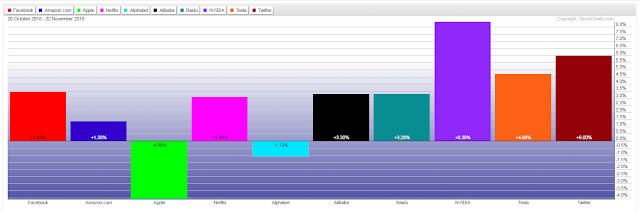

The following one week percentages gained/lost graph of the FNGU stocks show that NVDA, TWTR and TSLA have gained the most, while AAPL lost the most in this timeframe.

The following weekly chart of FNGU is showing a possible triple-bottom reversal in the making.

Both the momentum and rate-of-change indicators are well below their zero levels and, while the MOM is still dropping, the ROC is attempting to stabilize.

Last week’s closing price is below that of its open (52.17) when it first began trading back in January.

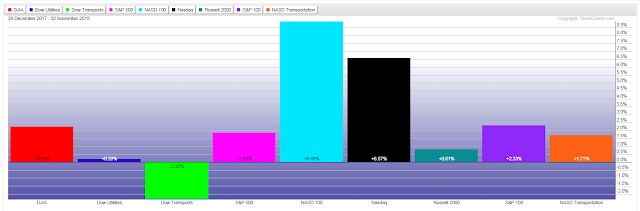

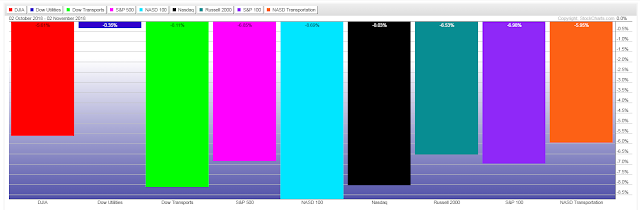

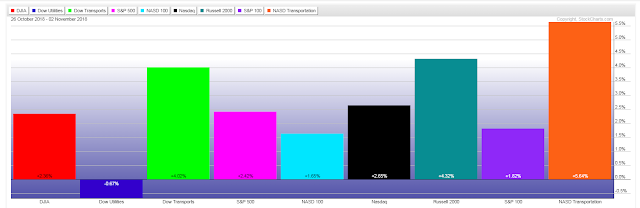

While the NDX has led the overall percentages gained year-to-date over the other U.S. major indices, it has lost the most on a one-month basis and has gained the least on a one-week basis, as shown on the following three graphs.

CONCLUSIONS

From the above observations, I’d suggest keeping an eye on the following going forward, particularly after the U.S. midterm elections on November 6:

- AAPL — further weakness could negatively impact U.S. equities, in general

- BABA and BIDU — further weakness could negatively impact China’s Shanghai Index (and vice versa)…I last wrote about the SSEC in my post of October 11, and what I’m monitoring is outlined there

- NVDA — further weakness could negatively impact U.S. equities, in general…I’ll be monitoring any actual progress on trade between the U.S. and China in light of softening rhetoric from both Presidents Trump and Xi in the last couple of days related to trade…however, talk is cheap and meaningless unless and until an actual trade agreement is finally hammered out and the tariffs removed

- FB — further weakness could negatively impact U.S. equities, in general…any further data breaches over and above those reported in the media lately could drive this stock to further accelerating losses

- NFLX — it appears to be forming a bearish head and shoulders pattern…watch for a break and hold below its neckline around 280-300 to signal much further weakness ahead

- AMZN — watching for a possible retest of 1400 if it breaks and holds below 1600

- GOOGL — watching for a possible break and hold below 1000 (major one-year support)…next support levels at 950, 850 and 800

- TSLA and TWTR — unless the other FNGU stocks reverse their declines, any further advancement on these two will not likely have much of a positive impact on U.S. equities, in general

- failure of the FNGU stocks to break and hold above, firstly the 20 MA, then the 50 MA, will likely produce further (potentially considerable) losses in U.S. equities, in general

- if the FNGU fails to break and hold above its IPO open at 52.17, we could see some hefty selling occur in these stocks and U.S. equities, in general