Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

That Not-So-Fresh Feeling

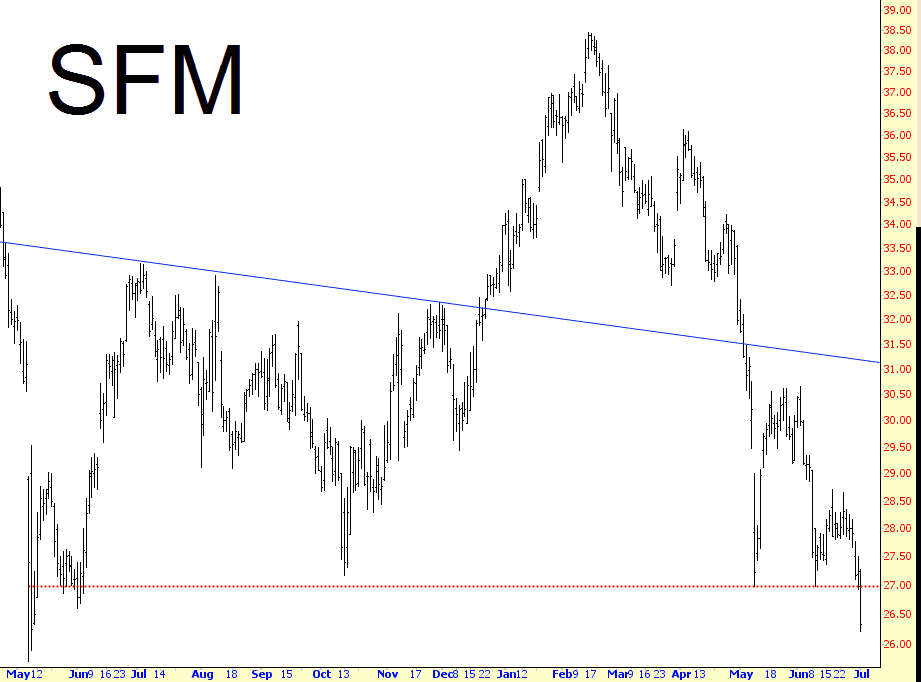

I shorted Sprouts Farmers Market yesterday for a couple of reasons. First, these Whole Foods copycats, from what I can tell visiting their stores, are pretty second-rate. I do a lot of grocery shopping, and there’s no way I would buy at SFM instead of Whole Foods. Second, along the same lines as my Blackberry short the other day, I’m no longer afraid of stocks that have already been clobbered. Anyway, so far, so good………..

Happy 70th Birthday, Debbie Harry!

Greek News Rollercoaster

More greek news overnight and at the moment SPX is trying to gap up 18 handles or so. Where the open is exactly today is very important as SPX retested and failed twice at the broken H&S neckline yesterday. If we see a gap up over that level at the open this could well be a gap up over resistance, and as long as 2073/4 is then respected as support then SPX is is free to play out the double bottom that with the opening break will have triggered with a target in the 2093 area, with declining resistance from the high currently in the 2092 area.

ES Short from Retracement Levels

Yesterday the market tried some recovery, amidst a flurry of news coming from Athens, Brussels and Berlin, regarding the risk of Greece defaulting on its debt. The bounce had retracted completely by the end of the day, but overnight the market is trying again the same rebound, so today the Close may be positive.

In the ESU15 DAILY chart below we can see the next valid support and resistance levels and we have highlighted the fact that the market will reach 100% odds to go SHORT DAILY at the 2091 level. This means that based on our DAILY model reading, the market is already OVERBOUGHT and marching towards a 100% OVERBOUGHT DAILY condition. A new pullback is nearly sure to happen before then. It is hard to say if it will be another sharp pullback or just a small one followed by higher prices. We can only say that when the odds are good, LONG or SHORT, you must take action to profit from the upcoming reversal.