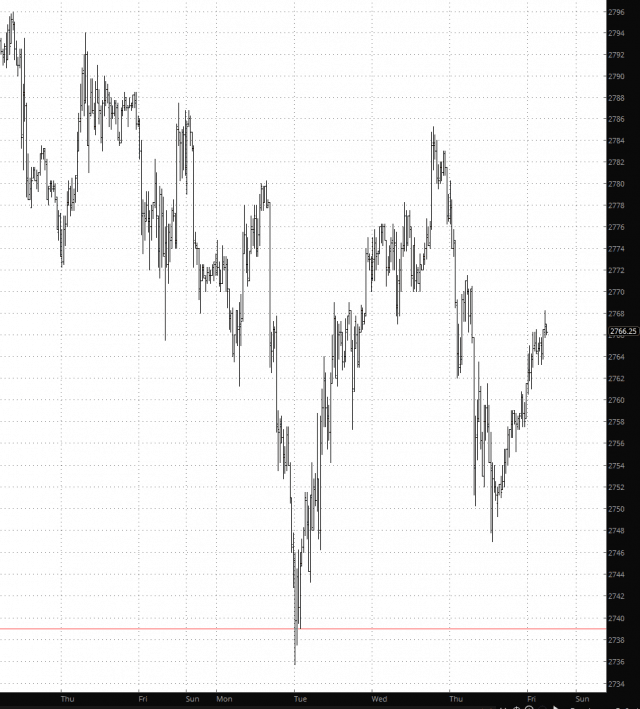

This hasn’t exactly been a week replete with vividly-clear direction. The kinds of words that leap to mind when looking at recent ES activity are “sawtooth”, “zig-zag”, and “wild reversals”.

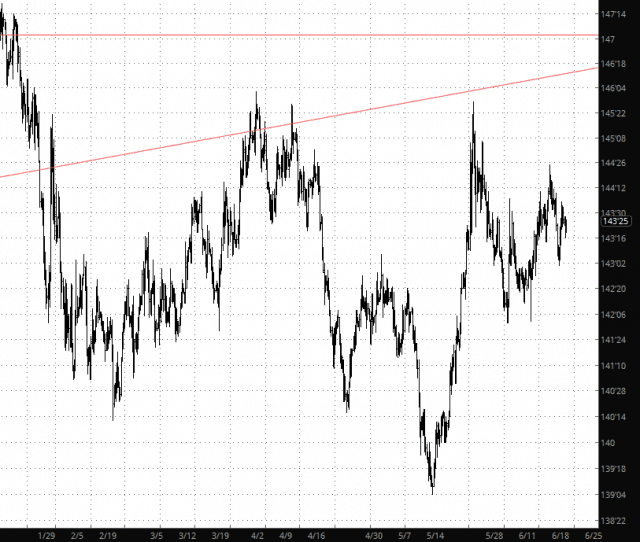

Although at least there is kind of a trend with equities. The bond market seems inscrutable these days. It has relaxed into a value of about 143 1/2 or so. As you know, my longer-term view is lower bond prices (and thus higher interest rates), but we’re stuck in the muck at the moment.

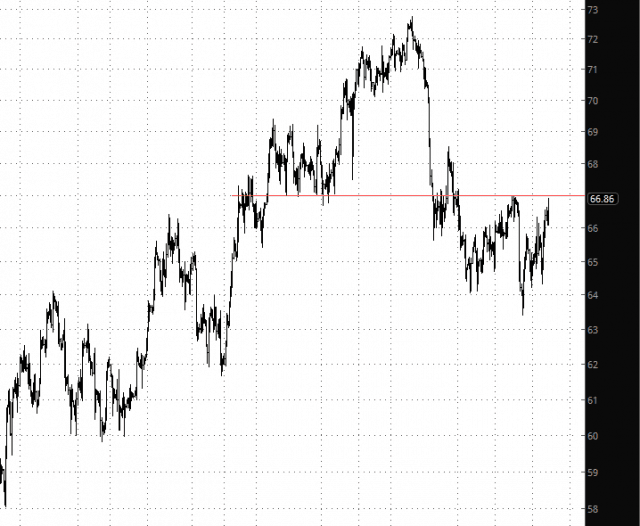

Crude oil, on the other hand, actually has some news driving it. The OPEC deal just got announced, and crude is quite strong this morning, up nearly 2.5%. If you take a step back, however, there’s a fair amount of overhead supply that is likely to suppress price action.

There was a big jump yesterday in SlopeCharts usage thanks to the new “Future Trend” feature. I appreciate all the positive feedback.